| Updated:

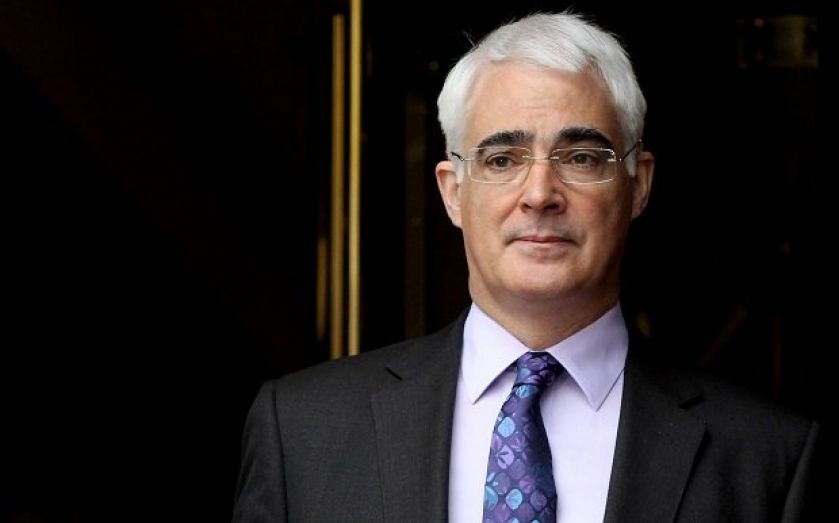

Alistair Darling warns of economic woes if tax powers are devolved to Scotland

Plans to devolve full tax and welfare powers to Scotland could lead to higher borrowing costs for the UK, according to Alistair Darling.

The Labour MP and former chancellor, who led the “Better Together” campaign in the run up to the independence vote on 18 September, said in the FT that giving Scotland full control would stop its residents from having to pay directly towards the upkeep of certain UK services, such as defence, financial protection and social services.

“It seems that the entire principle of pooling and sharing risks, one of the strengths of the UK and all successful monetary unions, is being undermined,” he wrote.

“For the first time in 300 years, a UK government would no longer have control over its power to raise income taxes. It could be left in a position where it determines the rate of income tax only to find it impossible to implement in Scotland, Wales and Northern Ireland.”

He added that there would be a risk related to bondholders, since they would question the UK's ability to raise income tax and so charge higher lending fees. This would “hit everyone throughout the UK,” he said.

Darling's warning comes just days before a cross-party deal on devolution is revealed by Lord Smith of Kelvin. It is expected to include full control over the rates and bands of income tax, as well more autonomy over welfare.

Prime Minister David Cameron has gone so far as to suggest that control over almost all benefit spending except pensions could be handed over to Scotland.

The deal represents a pro-union party delivery on promises to give Scotland more power, which were made in the run up to the independence vote. They were an attempt by all three major political parties to persuade Scotland to stay in the UK.

Since then, they have faced mounting criticism from the Scottish National party, now led by Nicola Sturgeon, which accuses them of not acting on those promises quickly enough.