Autumn Statement 2014: What does George Osborne’s stamp duty reform actually mean?

In an Autumn Statement firmly aimed at courting the popular vote, George Osborne today announced a complete overhaul of the stamp duty system – the elephant in the residential market for a decade. Estate agents said the old system wasn't progressive enough, and unfairly taxed home buyers.

The cherry on Osborne's stamp duty cake was to remove the slab system. Before today’s change, a house worth £250,000 would have been taxed at one per cent, while a house sold for £250,001 would be taxed at three per cent.

The new system is similar to the income tax framework, where in the £250,001 example, the buyer would pay the lower rate on the £250,000 and the higher rate on the extra one pound. The changes will therefore hit higher-priced properties and lessen the burden on those buying cheaper homes.

In recent years, estate agents have argued bitterly in favour of changes to the system The £250,000 boundary at which stamp duty rises from one to three per cent hasn’t changed since 2000. House prices are around 139 per cent higher now, forcing homes into higher bands.

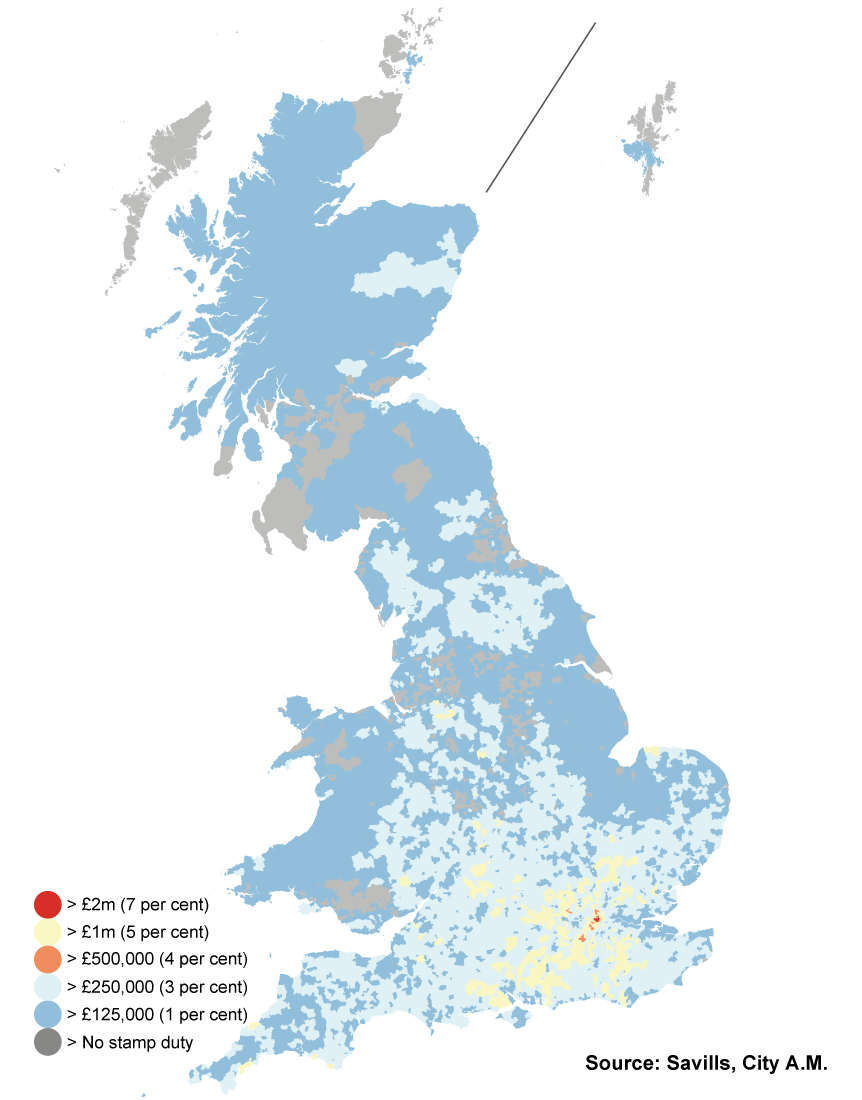

What's more, under the old system London prices accounted for over two fifths of the total: 42 per cent of stamp tax receipts came from the capital. A look at the banded framework shows why.

|

Purchase price of property |

Rate of SDLT |

|

£0 – £125,000 |

0% |

|

£125,001 – £250,000 |

1% |

|

£250,001 – £500,000 |

3% |

|

£500,001 – £1 million |

4% |

|

Over £1 million – £2 million |

5% |

|

Over £2 million |

7% |

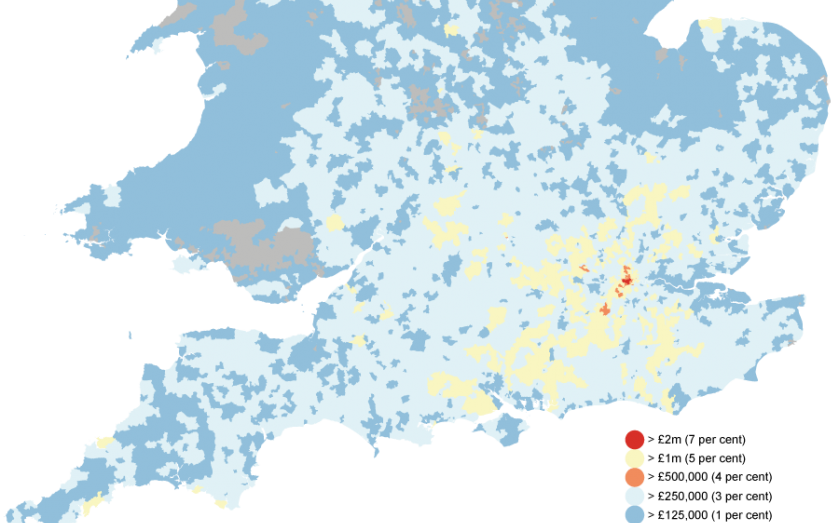

Data by upmarket estate agent Savills shows the average value of a house by ward. By mapping the average house price in each ward and colouring it by Stamp Duty Land Tax (SDLT) band, it becomes obvious why London is such a stamp duty gold mine.

In the wider South East, there are more higher-priced properties, but it is in London where the highest rate payers are found. Only 10 wards in the UK hit the old top end value, and they were all in London.

Osborne's changes represent a massive shift. The new system will mean any house valued at up to £125,000 will pay nothing, while houses up to £250,000 will pay two per cent. Purchases between £250,000 and £925,000 will incur a fee of five per cent. Over £950,000 buyers will pay 10 per cent, while homes over £1.5m will command a stamp duty of 12 per cent.

|

Purchase price of property |

Rate of SDLT |

|

£0 – £125,000 |

0% |

|

£125,001 – £250,000 |

2% |

|

£250,000 – £925,000 |

5% |

|

£925,000 – £1.5m |

10% |

|

Over £1.5m |

12% |