UK house price growth slows, but prices are five times average earnings

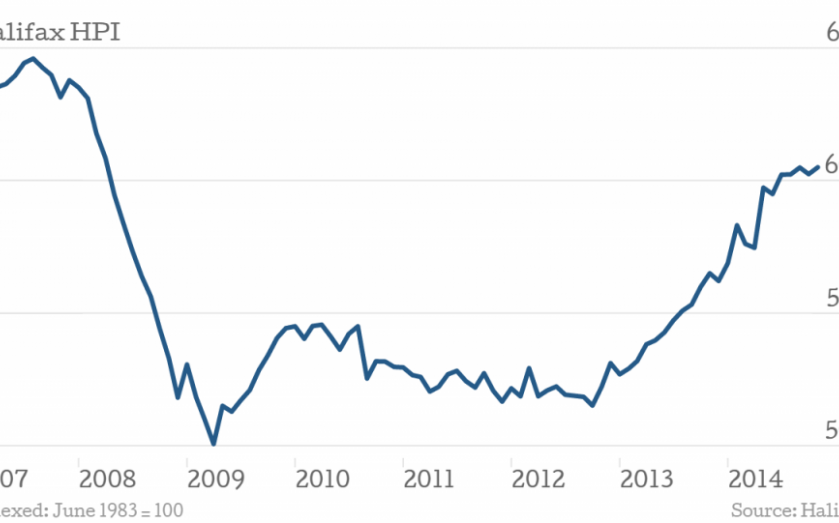

House prices across the UK were up 8.2 per cent in the year to November, another month of slower growth after October's 8.8 per cent rise. The price to earnings ratio is ticking up, however, and has reached a multiplier of 5.02.

Halifax’s house price index also showed quarterly prices up 0.7 per cent (slowing from 0.9 per cent in October) and a monthly change of 0.4 per cent, up 0.8 percentage points from a -0.4 per cent reverse in the previous month. The average cost of a house in the UK is now £186,941, according to the bank.

Martin Ellis, housing economist at Halifax, blamed slowing prices on a combination of a larger number of completions and waning buyer interest.

These factors have in turn contributed to the easing in house price growth since the summer. But housing demand continues to be supported by a strengthening economy, rising employment levels, still low mortgage rates and the first gain in ‘real’ earnings for several years. We expect a further moderation in house price growth over the next year with prices nationally expected to increase in a range of 3-5 per cent in 2015.

Despite slowing growth, houses are becoming less affordable. Although the heady pre-crisis peaks of prices being 5.8 times the mean annual salary are some way off, the last couple of months have seen prices break through the barrier of five times. What is more, Halifax uses the mean wage to calculate the ratio.

Using the median wage, which removes high and low earners that can skew the average, would push the ratio up still further (although we'd then need to look at median house prices too).

The higher cost of housing is one of the things (another possibly the looming election) that persuaded George Osborne to remove stamp duty slabs in yesterday’s Autumn Statement.

There is plenty of other data to support a cooling of the market. Home sales fell in October to 98,490, the first time this year that the total has been less than 100,000.

Mortgage approvals were also down, with Bank of England data showing the total was 59,426 in October, a 22 per cent drop from January’s figure 76,574