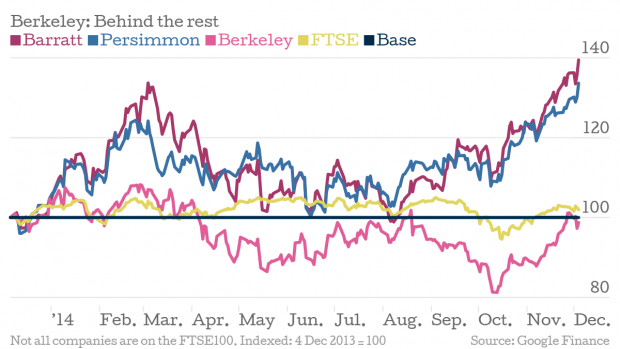

Berkeley reports another stonking set of profits

The figures

Housebuilding giant Berkeley Group reported this morning that profits before tax leaped 79.9 per cent to £305m in the six months to the end of October. Revenue also rose, to a touch over £1bn, a jump of 24.5 per cent, while earnings before share increased 78.6 per cent to 178.6p.

Why it's interesting

Since founder/CEO/chairman/all-round property oracle Tony Pidgley legendarily called the top of the housing market just before the house price crash, all eyes have been on Pidgley and his team for an indication of when/if the housing bubble is going to burst, particularly given the economic storm blowing across the channel. So far, the company has enthusiastically continued buying land in London, despite slowing growth in London house prices. But today Pidgley hinted that as long as there's land in London, Berkeley will continue buying it.

That said, George Osborne's little stamp duty surprise may cause it problems. The company deals almost exclusively in central London new-builds, and although many of its homes are affordable, a significant portion of its offering falls into the £1m plus category about to be hit hard by a rise in stamp duty. So analysts, investors and Pidgley's property peers are likely to be anxiously watching Berkeley to see what, if anything, it does next.

What Berkeley said

This week's announcement on the changes to stamp duty have been well-received by the market generally, but is a further change and we are yet to see consensus from the parties on the likely shape of policy after the general election, which means continuing uncertainty.

In short

Berkeley is a bellwether for the London property sector: where Tony Pidgley goes, others follow – and he seems unperturbed by slowing prices, economic headwinds in Europe, and unpleasant surprises in the form of stamp duty.