FTSE 100 edges up as oil and metals recover – London Report

Energy and mining stocks rallied to help the UK’s top share index end slightly higher after a sharp decline earlier in the session, buoyed by a recovery in crude oil and industrial metals prices.

Expectations the European Central Bank will take fresh measures to support the region’s economy and that the US Federal Reserve’s final statement of the year will be less hawkish also improved sentiment, analysts said.

The FTSE 100 index finished 0.1 per cent higher at 6,336.48 points after hitting an intra-day low of 6,240.32 points.

“A stabilisation in crude oil prices has helped calm fears in the equity markets. We believe that we are still in a ‘buy-the-dips’ market environment,” Robert Parkes, equity strategist at HSBC, said.

“For European markets, we are getting some favourable tailwinds in terms of currency and oil price moves, but the growth environment is pretty lacklustre. On balance we expect the market to gradually grind higher next year.”

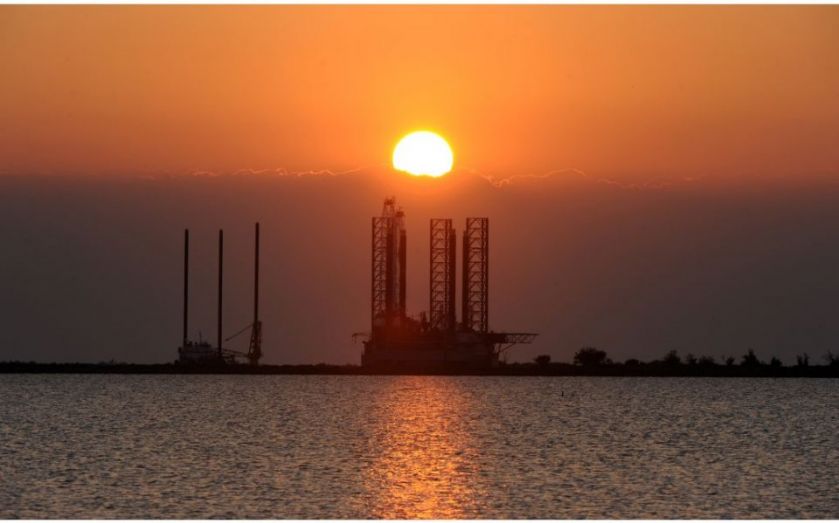

The UK oil and gas index surged 3.4 per cent, helped by a 3.3 to 3.6 per cent jump in shares of oil companies such as BP, BG Group and Tullow Oil after a late rally in crude oil prices.

Brent crude, which is still down nearly 50 per cent in six months, moved above $60 a barrel on as data showed falling inventories.

Analysts said the market also got some support from comments by senior European Central Bank policymaker Benoit Coeure, who said he saw a broad consensus on the bank’s governing council for more action namely, buying government bonds.

Miners also bounced following a recovery in metals prices. The UK mining index rose 1.8 per cent, helped by a rise of 0.7 to 2.7 per cent in shares of Rio Tinto, BHP Billiton and Anglo American.

Among other movers, Lloyds Banking Group was down two per cent. The body which manages the state’s shareholding said it will sell more shares in Lloyds in the next six months.

Dixons Carphone rose three per cent after the electricals and telecommunications retailer posted a 30 per cent increase in first-half profit.

Mid-cap Catlin Group rose 10.8 per cent after saying it received a takeover approach from XL Group.