US oil and gas M&A falls to 12-year low as oil prices fall

Mergers and acquisitions in the US oil and gas sector were at their lowest since 2003 in the first half of this year, new data has suggested.

A survey by Dealogic showed M&A volume fell to $29.5bn (£19bn) over 202 deals in the six months to the end of June, down 50 per cent from the $59.9bn spent over 356 deals in the same period last year.

Cross-border deals were a fraction of last year's $7.9bn figure, falling to $374m, its lowest since 1996.

The news comes on the same day the US International Energy Agency (IEA) warned that growth in oil supply this year is likely to be higher than demand.

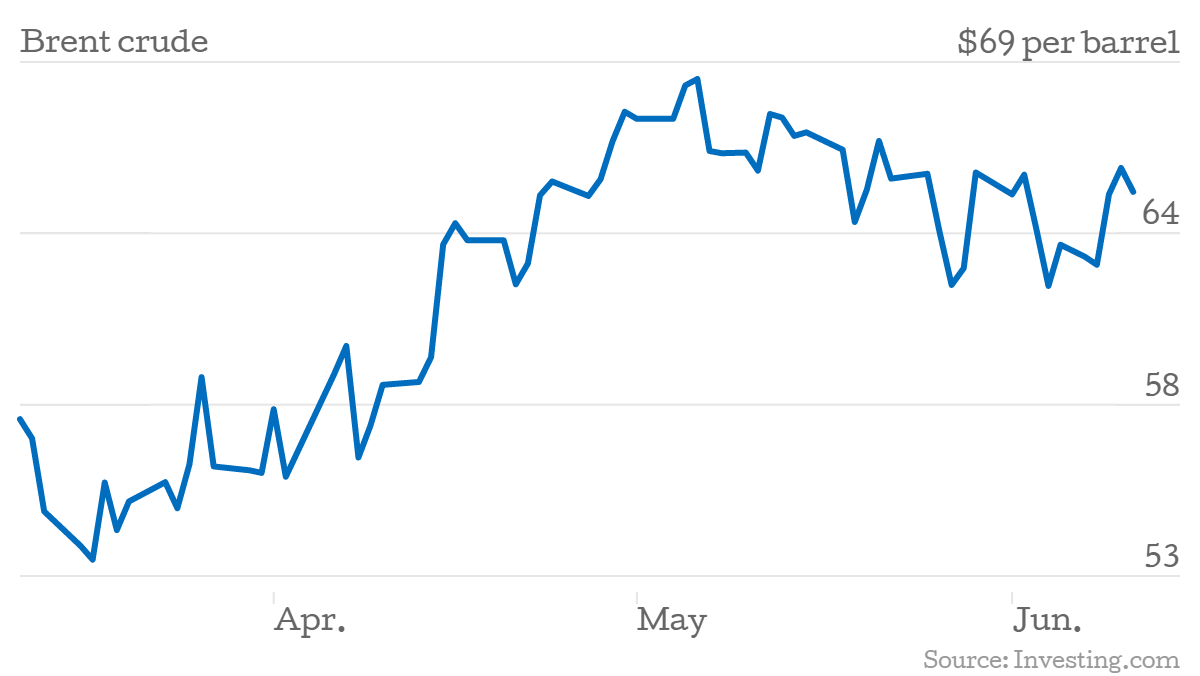

Brent crude was down 1.1 per cent, at $64.98 a barrel in afternoon trading, while the US benchmark, West Texas Intermediate, had fallen one per cent to $60.80.

Yesterday, a report suggested falling prices had forced more than two-thirds of North Sea oil firms to scrap projects. The report, by Aberdeen Chamber of Commerce and Bond Dickinson, showed the only growth in the sector had been around decommissioning projects in the North Sea.