UK bank shares: A pre-Brexit view

Some UK bank shares have made massive profits for shareholders, but how should you play the sector now?

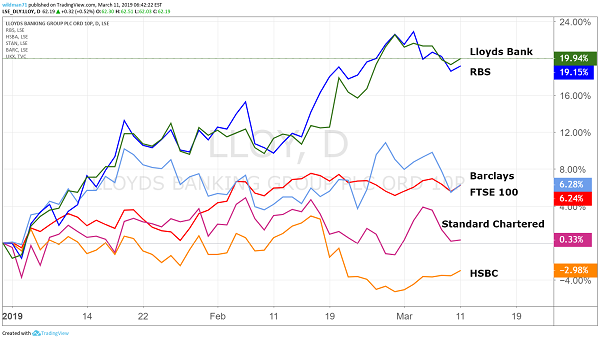

It’s been a few weeks since the last of the big UK-listed banks published results for 2018, and share price performance since has been varied. Brexit, of course, has played its part and, with some lenders up around 20 per cent in 2019 so far, sector analysts are urging some near-term caution.

Since The Royal Bank of Scotland Group (LSE:RBS) published full-year results on 15 February, its shares have been among the best performing of the UK domestic banks, up 6.6 per cent . Only Lloyds Banking Group (LSE:LLOY) has done better over the same time period, up 7.3 per cent. An unconvincing Barclays (LSE:BARC) is up 1 per cent, although it’s still outperformed a 0.8 per cent decline for the FTSE 100 index.

In a very clean example of geographical favouritism, it’s the Asia-focused lenders that have done worst. Standard Chartered (LSE:STAN) is off over 3 per cent since mid-Feb, and HSBC (LSE:HSBA) 5.5 per cent lower. While there are issues specific to each of these banks – weak Q4 2018 profits are one – the reduced risk of a no-deal Brexit has given sterling a boost. A negative for these overseas earners, the shares have suffered a de-rating.

But with potentially a week of Brexit votes by MPs ahead of us, UBS analyst Jason Napier believes shares in the domestic banks, many of which have outperformed the wider market in 2019 so far (see chart below), will likely remain rangebound, “or worse”.

Source: TradingView

Clearly, economic activity is being materially impacted by near-term uncertainty around Brexit, and the key trends remain consistent with those seen in the fourth-quarter of 2018.

However, the regulatory environment is likely positive for UK banks. While requirements on CET1 ratios (a measure of financial strength) at which UK lenders are asked to operate, it is happy for banks to distribute net capital generation once CET1 ratios have been achieved.

That certainly compares favourably with the European banks. As Napier points out, only last week, the European Central Bank said it would launch a new series of quarterly targeted longer-term refinancing operations (TLTRO-III), starting in September. Implication here is that the rate cycle in the UK is “some distance ahead of that of the ECB”.

“Near-term political issues aside, we retain a preference for UK domestic banks over the internationals,” writes Napier. “We think a combination of attractive valuation, strong capital generation, rising rates and stable regulatory capital requirements increasingly set the UK apart from the eurozone.”

“Though there may be some investor profit-taking in Lloyds Bank and RBS in the very short term, it remains our base case that some Brexit resolution – by extension or approved deal – will lead to compression in UK domestic bank cost of equity ahead of rate hikes by the [Bank of England] which would be good for all the banks, but most powerful for RBS in our view.”

(Source: UBS estimates. Priced on 8th March 2019.)

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.