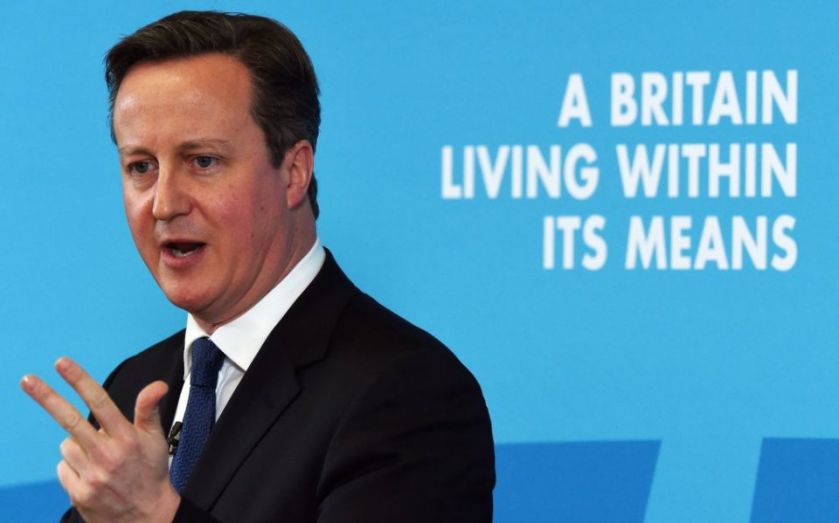

With public borrowing still high, is David Cameron right to renew his pledge of £7bn in tax cuts?

John Longworth, director general of the British Chambers of Commerce, says Yes

The Prime Minister is absolutely right to go into the General Election campaign with a plan to cut taxes – even in the face of continued public spending restraint and necessary belt tightening.

Lower personal taxes can be a fillip to businesses, who benefit most obviously through increased consumption. Crucially, lower taxes also boost the aspirations and optimism of entrepreneurs. Further, historical evidence suggests that lower tax rates often result in higher receipts for the Exchequer.

It would be good to see the Prime Minister’s vision for a lower-tax environment extend to include more of the onerous input taxes that drag down firms – with business rates and employers’ National Insurance contributions at the top of the list. Cutting these upfront taxes, which hit before companies turn over a single penny, would help firms succeed – with more corporation tax and income tax receipts for the Treasury as a result.

Andrew Harrop, general secretary of the Fabian Society, says No

David Cameron’s £7bn in tax cuts will overwhelmingly benefit households with above average incomes. Most of them have barely felt the effects of austerity, according to the Institute for Fiscal Studies.

Simultaneously, the Conservatives are promising to take £12bn from the pockets of low and middle income families through benefit cuts. These are the people who have really been the victims of austerity so far.

So Cameron is promising to give away money to those who already have enough, and to take it away from the people struggling to get by. He is conjuring a Britain of golf clubs and food banks, each booming side-by-side.

In truth, it is a fiscal fantasy – a castle built on sand. For the Conservatives have no idea how they’ll make yet more cuts to vital public services and to the incomes of families struggling to get by. As events in Greece have proved, austerity cannot last forever.