Apple share price shockwave put markets on edge as tech company stocks tumbled

Technology stocks across the globe fell like dominoes yesterday, feeling the aftershock from Apple’s tumbling share price.

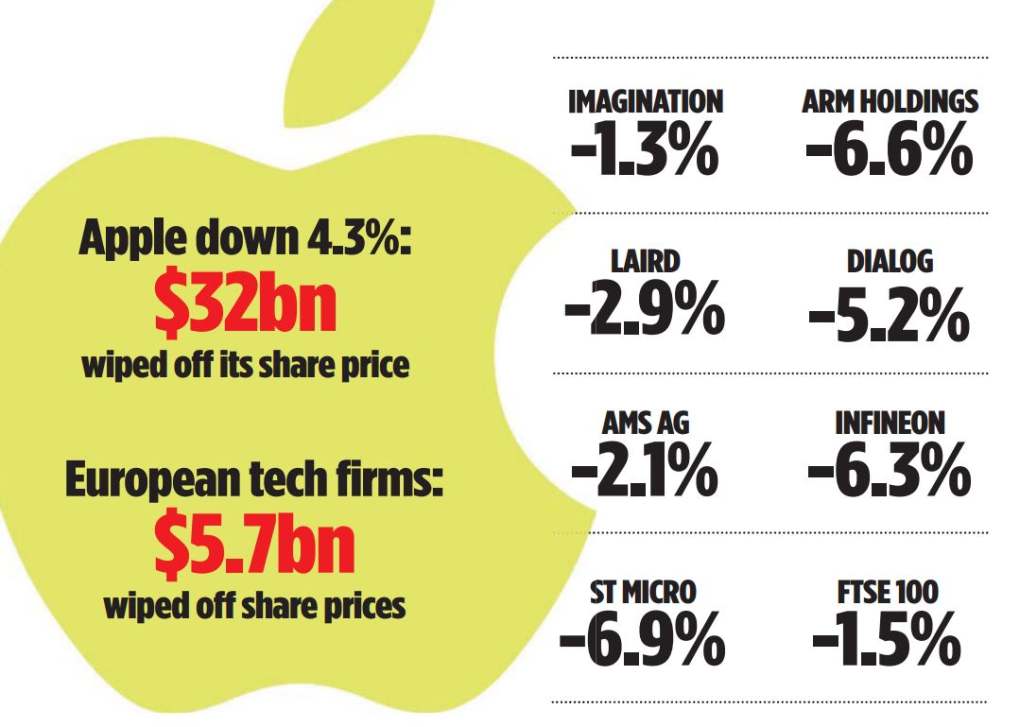

The California-based smartphone giant dropped by more than seven per cent in pre-market trading after releasing its results for the third quarter, and its shares lost another four per cent of their value throughout yesterday.

US tech companies, including Yahoo and Microsoft, felt the chill of Apple’s decline, dragging on Wall Street – and the change in sentiment sent shockwaves across the Atlantic.

The FTSE dropped 101.73 points, led down by chipmaker Arm Holdings. The Cambridge-based firm lost 6.64 per cent despite yesterday posting a pre-tax profit of £124m, up 32 per cent and just missing analysts’ expectations, given its status as a major supplier to Apple.

Other London-listed companies taking a hit included semiconductor manufacturer Imagination Technologies, down 1.34 per cent, and electronics firm Laird, which dropped 2.87 per cent.

Elsewhere, German chipmaker Dialog Semiconductor suffered a 5.22 per cent reduction.

As stocks turned red across the world, traders highlighted the fragility of the tech sector, with some speculating that the market could be experiencing a tech bubble, similar to the dotcom boom of the late nineties.

Speaking to City A.M. after the closing bell in New York, Keith McCullough, chief executive at Hedgeye Risk Management, warned that the tech market was heading for trouble.

Read more: Why investors are wrong to punish Apple

Adding that European and Asian markets would not be immune from the effects of a US slowdown, McCullough said the market was “obviously” in another bubble. “I think we’ll call this one the cloud of expectations,” he said.

Mike O’Rourke, chief market strategist at JonesTrading, took a less drastic view of the market, but said global tech stock prices need to change. “Prices need to consolidate or correct, or earnings need to pick up,” he told City A.M..

O’Rourke said he did not see the current situation as being on a par with the dotcom crash, but acknowledged there is a risk that “the entire market will roll over”. Yet he added: “I wouldn’t say prophecies of doom are appropriate – but I would say caution is.”