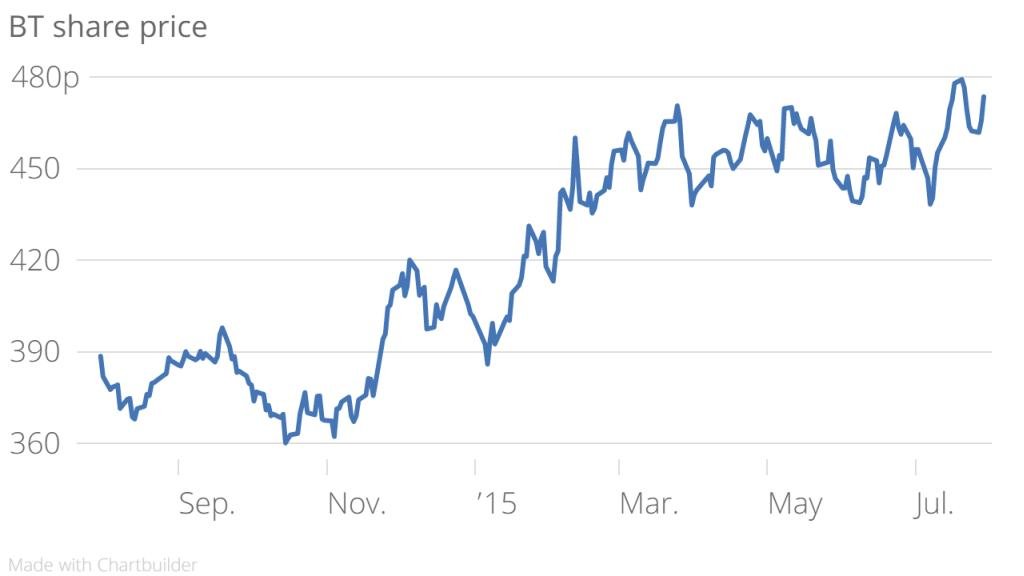

BT shrugs off break-up talks to increase profit before tax by 16 per cent

The likes of Sky may be after its head, but that hasn't prevented BT from posting a 16 per cent rise in pre-tax profit, despite a modest fall in revenue. BT's share price fell three per cent in mid morning trading following the announcement.

The figures

The telecoms giant reported a two per cent fall in revenue to £4.3bn in the first quarter to 30 June.

But reported profit before tax climbed 16 per cent to £632m, while reported earnings per share increased nine per cent to 6.1p.

Net debt also fell £1.26bn to £5.82bn.

Capital expenditure increased 28 per cent to £658m in 2015 from £516m in 2014.

Why it’s interesting

BT shares have climbed in recent years, largely thanks to the success of its broadband and new TV channel launches, which have allowed the company to provide upbeat forecasts.

Among the highlights this time round were the impending launch of its new BT Sport Europe channel, which begins airing on 1 August, hosting some Champions League Football. Then there was the deal to buy the UK's biggest mobile network, EE…

The only spanner in the works during the quarter was Ofcom, the UK media regulator, which earlier this month began looking into a break-up of BT and its "final mile" broadband company, Openreach, saying splitting the two could encourage competition in the market. That came as music to the ears of Sky and TalkTalk, which have been urging such a breakup for a while.

BT hasn't reacted to provocation, saying simply that it is "engaging with Ofcom as part of its strategic review of digital communications which offers scope for deregulation and the potential to create a more level playing field in pay-TV".

What BT said

Gavin Patterson, chief executive, said:

Our mobile plans have got off to a good start with more than 100,000 consumer mobile customers signed up in the first three months. We're also looking forward to completing our acquisition of EE, which will allow us to create a true UK digital champion, providing customers with greater choice and value and helping to deliver the UK's connected future.

We have also invested further in improving customer service and Openreach is running ahead of all 60 minimum service levels set by Ofcom for this year. The investments we are making in our business and customer service are building a strong platform for growth. And our financial results show we're on track to achieve our outlook for the full year."

In short

BT has shrugged off talks of a spin-off of its Openreach division, meeting analyst expectations with a 16 per cent jump in profits.