FTSE boosted by miners on good Chinese figures – London Report

BRITAIN’S top share index rebounded yesterday after its biggest weekly drop of 2015, with mining stocks boosting the market on expectations of steady economic growth in China, the world’s biggest metals consumer.

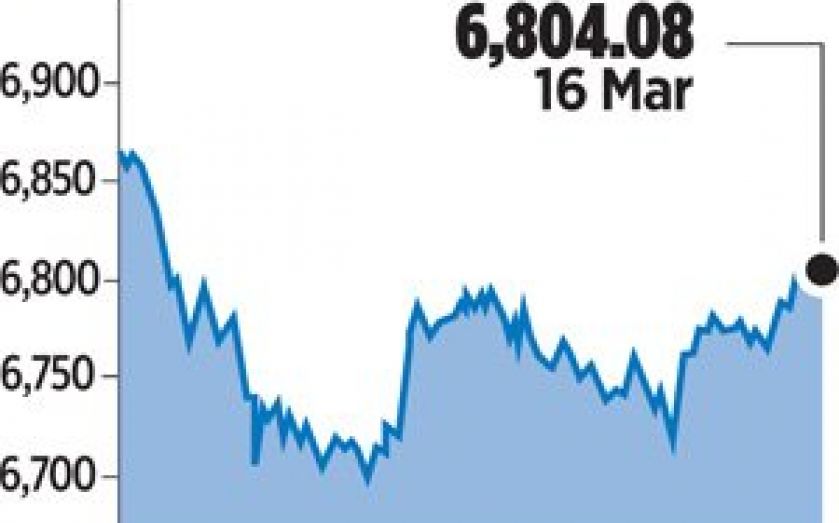

The FTSE 100 closed 0.9 per cent higher at 6,804.08 points after dropping 2.5 per cent last week in what was its biggest weekly decline since December, touching its lowest level in nearly two months.

Yesterday’s rise left the index less than three per cent off an all-time high it reached in early March.

Tesco shares rose 3.7 per cent on news that WPP, the largest advertising company globally, was eyeing a majority stake in the Dunnhumby customer data unit of the third-biggest retailer worldwide.

“Cost-cutting measures are being used [by Tesco] as part of a wider reform strategy and the selling of the Dunnhumby data unit [if it goes ahead] will have come as a welcome, even attractive prospect to investors,” Augustin Eden, an analyst at Accendo Markets, said.

Among leading sectoral gainers, the UK mining index rose 0.8 per cent after Chinese Premier Li Keqiang said on Sunday the country had a lot of room to manoeuvre its policy and boost the economy.

“We believe that market optimism on the mining sector is at a pretty low level on concerns regarding supply-side issues and the sustainability of Chinese growth. And that makes the sector sensitive to any good news coming through,” said Robert Parkes, equity strategist at HSBC Global Research.

“We are overweight on the mining sector and believe that the pessimism is overdone especially in the current environment where the business cycle indicators are starting to point upwards.

“It’s a cyclical sector and is exposed to a re-acceleration in the global economy.”

Mining companies were the biggest gainers in the blue chip index, with Rio Tinto, BHP Billiton, and Randgold Resources up one to 1.3 per cent.

On the downside, Irish construction company CRH — which has agreed to buy assets from Lafarge and Holcim — fell 4.4 per cent after Holcim called a halt to its merger with Lafarge, pressing the French company to renegotiate the deal terms.

Tullow Oil slipped 5.7 per cent following a sharp drop in crude oil prices and as Exane BNP Paribas cut its target price for the stock by five per cent.