Eurozone inflation beats expectations rising 0.3 per cent in May

Eurozone prices rose for the first time in six months in May – ending a series of disappointing readings which had suggested the euro area risked falling into a damaging deflationary spiral.

A flash estimate by the bloc's official statistics agency said euro area inflation was 0.3 per cent in May, beating analysts' estimates, and up from zero last month.

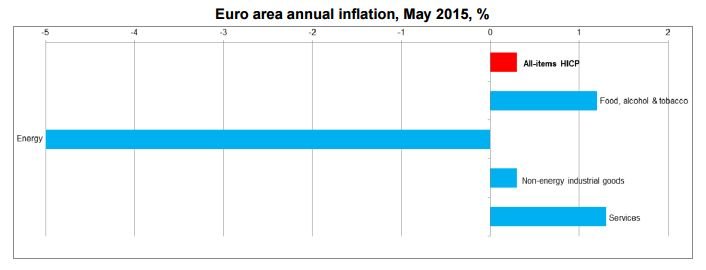

Food, alcohol and tobacco, as well as the services sector, rose 1.2 per cent and 1.3 per cent respectively. Declines in energy prices slowed slightly, falling five per cent last month, compared with 5.8 per cent in April.

And core inflation – which strips out the more volatile sectors such as food and energy – jumped to 0.9 per cent.

"The further rise this month should underscore the transitory nature of inflation’s recent foray into negative territory," Timo del Carpio, European economist at RBC Capital Markets, said.

The figure tumbled towards the end of last year as global oil prices fell from about $115 (£75) per barrel in June, to just $45 per barrel in mid-January. Prices have since recovered slightly to hover at around $65 per barrel.

At the time economists worried that the single currency bloc risked falling into a "deflationary spiral" whereby a lack of demand curtails spending and thus business investment.

This pushed the European Central Bank to unleash its large scale bond-buying programme, first unveiled in March, under which a total of €1trn (£720bn) will be pumped into the Eurozone until September 2016.

This programme followed other measures to boost the Eurozone economy such as cutting the main interest rate to 0.05 per cent, and its deposit rate to – 0.2 per cent.

However, analysts have warned it is still too early say what this means for the future policy trajectory, saying near-term inflation will continue to depend on oil prices, while broader euro area growth looks weak.

"For starters, we consider that oil price dynamics (including base effects from last year’s decline) will continue to drive much of the short-term path for inflation in 2015," del Carpio said.

"Moreover, despite the upward move in core inflation this month, we judge that more general inflationary momentum will remain muted against a backdrop of still anaemic domestic demand in the euro area, coupled with ample spare capacity in the labour market."

"Thus, while today’s out turn may provide further breathing room for the governing council – by reducing the risk of a more pernicious deflationary environment taking root – it is far from sufficient to precipitate a change of course."