Tax credit cuts poll: Over half of Londoners want chancellor George Osborne to make changes, but Britons accept it as necessary

Two polls on chancellor George Osborne's controversial decision to cut tax credits have found that six in 10 Londoners want chancellor George Osborne to amend the government's controversial decision to cut tax credits, but many Britons accept it is necessary.

A London based poll, released by campaigning group 38 Degrees and conducted by YouGov, shows 58 per cent of Londoners want Osborne to abandon his current plans, with 23 per cent of respondents having said the cuts should go ahead but at a later date or with a lower rate of cuts.

Some 19 per cent said the cuts should not go ahead altogether, and 16 per cent thought cuts and changes should be made elsewhere. A total of 12 per cent said they will be worse off as a result.

A further 42 per cent of people in London suggested David Cameron has broken a pre-election promise by cutting tax credits, compared to just 27 per cent who didn't.

"This poll shows tax credit cuts are turning into a political disaster for the government," said Rebecca Falcon, campaigns manager at 38 Degrees.

Read more: Osborne's "rhetoric on tax credits is just empty words"

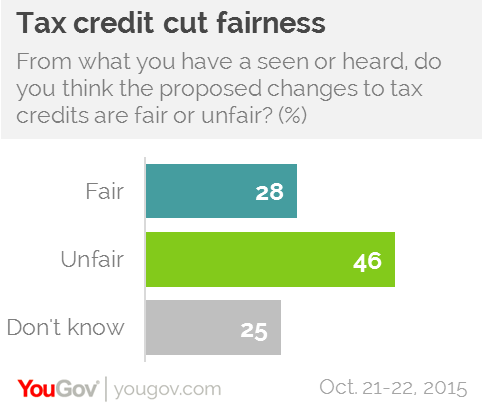

A separate YouGov poll found the public's view is that while the cut is largely unfair and painful, it's necessary.

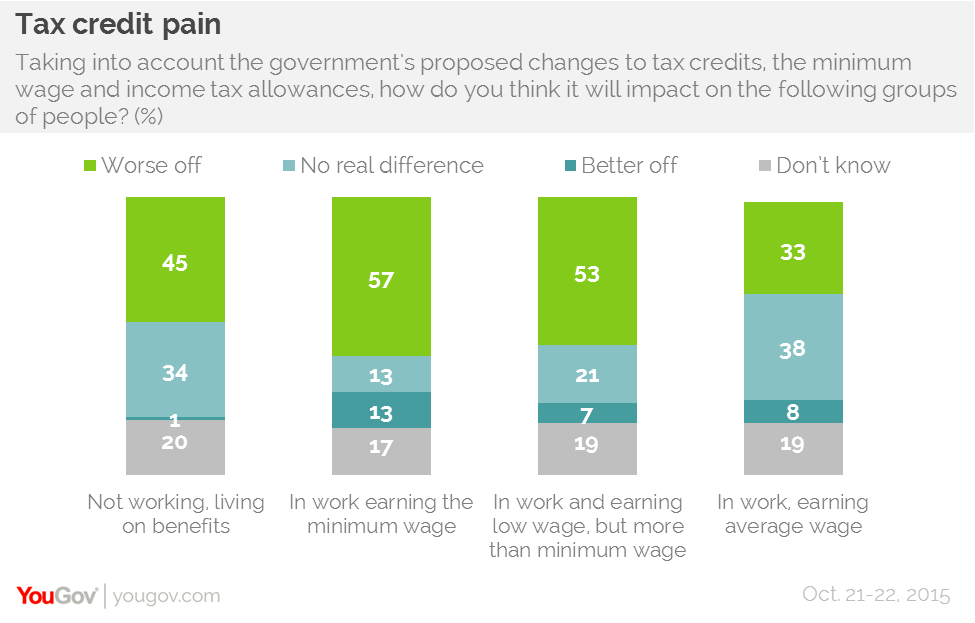

The poll showed British people tend to acknowledge the cuts will make large groups of working people worse off, but that the government must do it anyway.

Chancellor George Osborne has been facing pressure to U-turn on the proposals, even from within his own part. While the billed passed through the Commons last week, it faces being blocked by peers in the House of Lords today.

Read more: Prime Minister David Cameron is "acting like a school boy bully"

Most of those surveyed believe that tax credit cuts are unfair:

Among those who have been "following the story", 63 per cent said the plans were unfair. There is also a small but not insignificant group of people – around one in eight, or 13 per cent – that agree the cuts are unfair, but then also say they should go ahead given the size of the deficit and the need to cut spending.

Most also agreed tax credits wil make people worse off.

Most recently Osborne has been under pressure from the Treasury Select Committee. Helen Warrell, who sits on the committee, said: "The evidence we took in the Treasury Select Committee conclusively proves that those who have tax credits cut will not be fully compensated by increasing the national living wage. Osborne's rhetoric on tax credit cuts is just empty words."

Later today the House of Lords will vote on two amendments to the proposed cuts to in-work benefits, with one amendment – a “fatal motion” – seeking to prevent consideration of the bill until a report has been published considering the Institute for Fiscal Studies analysis of the impact of the cuts. The other proposal, put forward by the bishop of Portsmouth, is a so-called motion of regret, which would call on the government to consult further on the cuts but would not stop them from going into effect.