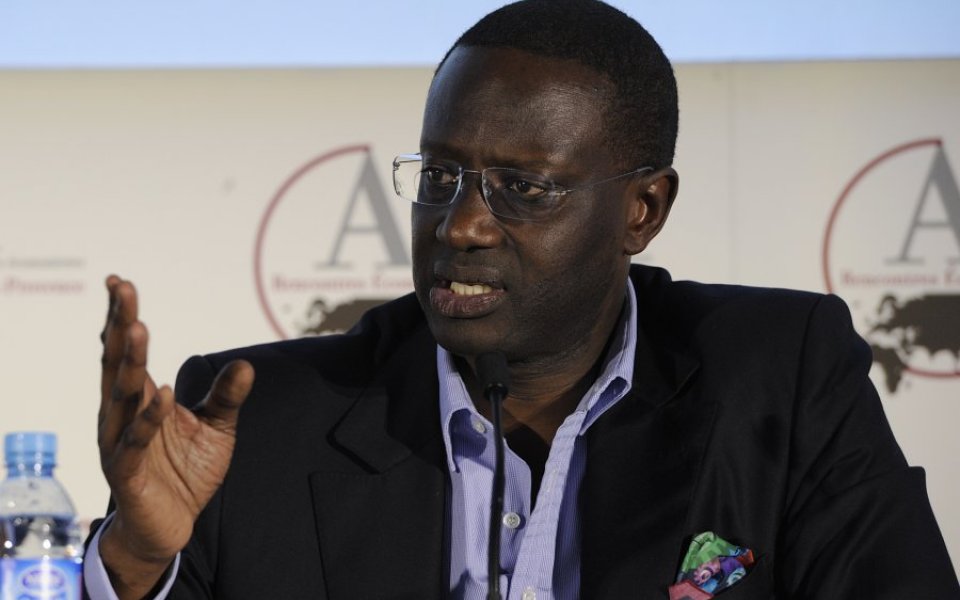

Credit Suisse boss Tidjane Thiam sees possibility of “traumatic” market event as interest rates go up

Credit Suisse chief exec Tidjane Thiam, who joined the company from Prudential this year, has warned of the likelihood of a “traumatic event” in global markets once interest rates start to creep up from record lows.

“Frankly, it’s quite likely that there will be at the end of all this period a relatively traumatic event,” he said in an interview with Bloomberg Television.

“We’ve had this long period of low interest rates, there will be impact once rates start rising,” he said.

Thiam stressed the importance of central bank communication and ensuring that decisions were transparent.

Central bank interests rates in the US have been near zero since December 2008, and were widely expected to rise in September before a number of events such as lower commodity prices weighed on inflation and financial markets became more volatile.

They have been at 0.5 per cent in the UK since March 2009, with the Bank of England recently hinting that rates could stay at rock bottom until 2017. The Bank recently tried to revamp its communications by publishing details of its rate decisions on the same day as the decision rather than with a two-week delay.