Gifts all round or is the Grinch in town? Here’s why Santa Rallies happen – and whether you can expect one this year

It's been a tumultuous year for the FTSE, which has spent the past few months merrily yo-yoing from the heady heights of 7,100, before careering to below 6,000 points months later.

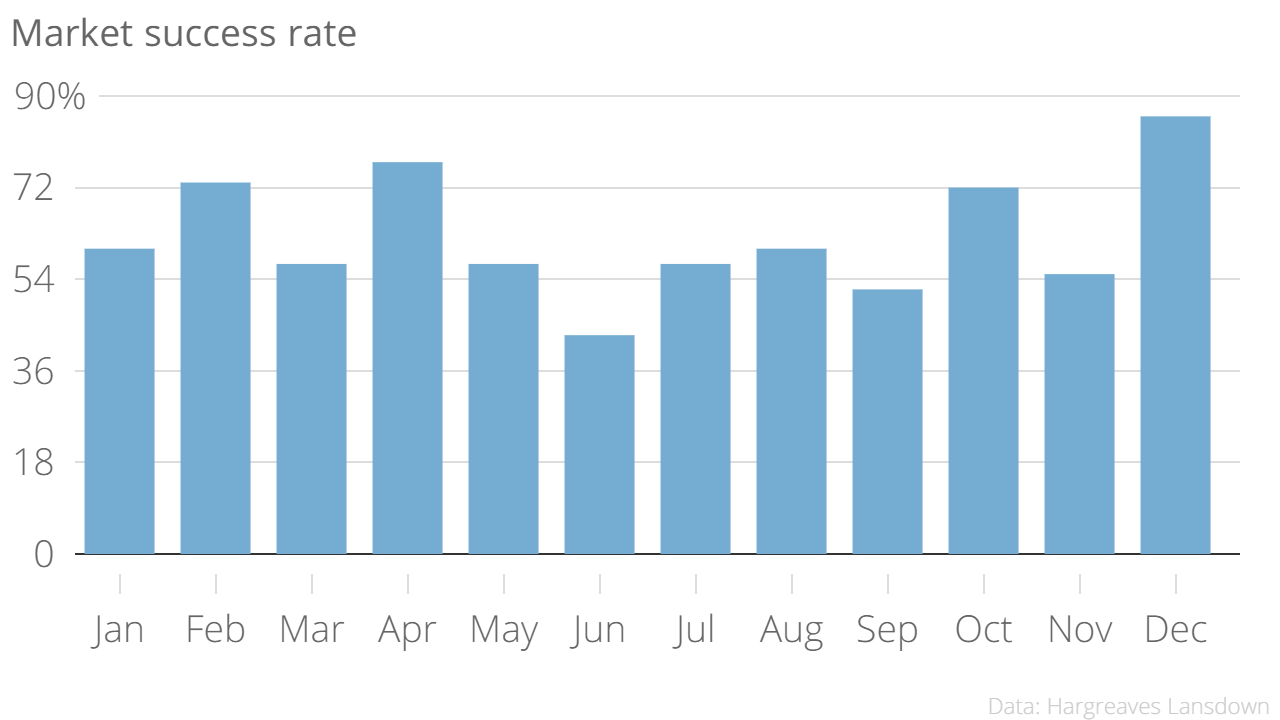

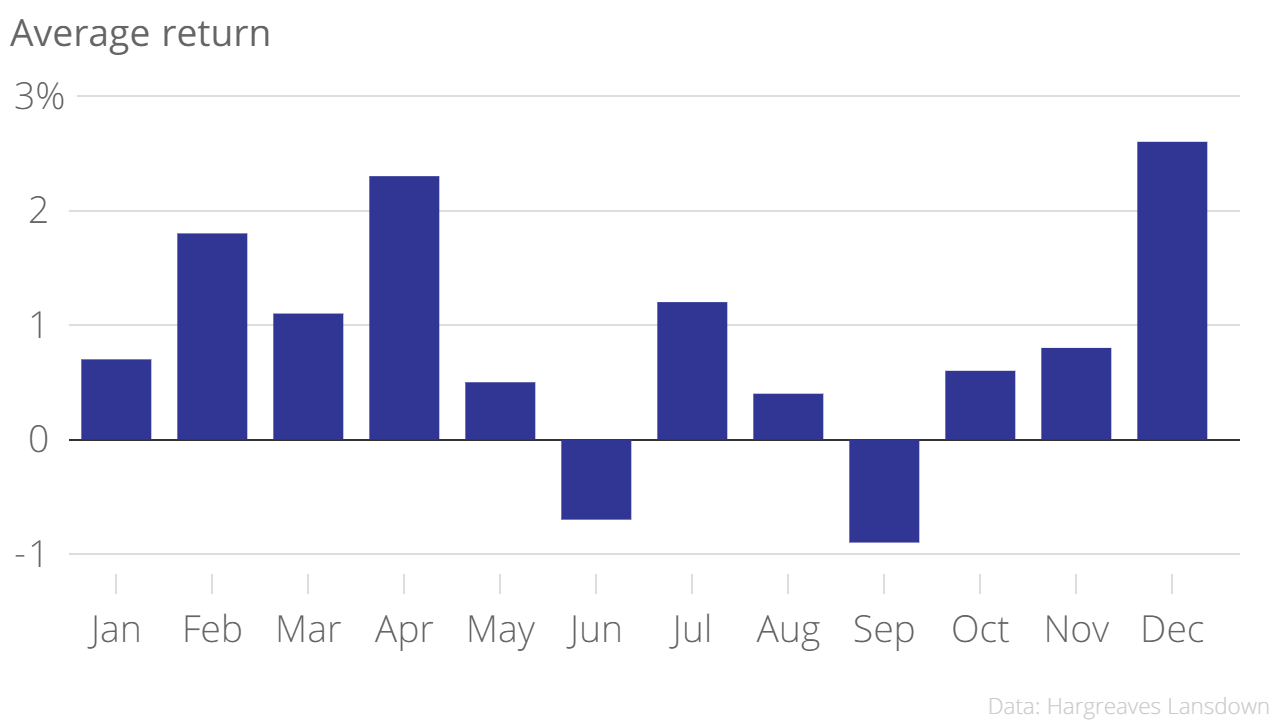

Could some festive merriment be sprinkled over the index by a Santa rally, despite the fact it's failed to make gains this year? Potentially: research by Hargreaves Lansdown has suggested December is historically the best month of the year for equities.

According to the research, the FTSE All-Share index rises 86 per cent of the time in December, with an average return of 2.6 per cent.

The research suggests £10,000 invested in the stock market 30 years ago would now be worth £152,500, had dividends been reinvested. Strip out December each year, though (for present-buying funds…), and it would be worth a paltry £72,800. You can barely buy an iPad for that….

That doesn't mean Santa doesn't follow trends, mind. The findings suggest if the market has fallen in the 11 months to December, it only rises 63 per cent of the time. If it's risen in the months before December, it rises 99 per cent of the time.

Why do Santa rallies happen? The researchers have three theories:

Theory 1: People invest their Christmas bonuses – a nice idea which probably credits us with a superhuman level of prudence.

Theory 2: Fund managers engage in ‘window dressing’ – selling losers and buying winners so their end of year accounts publish a list of what looks like the year’s best stock picks. However in practice this would probably raise some pretty awkward questions for under-performing fund managers, i.e. why has your fund performed so badly when you hold so many winning stocks?!!

Theory 3: Investors feel more optimistic than usual – an outbreak of good cheer. Perhaps the best explanation we have without being particularly scientific.

So there you have it: the reasons behind the stock market's most festive tradition. God bless us, every one…