Moody’s says the outlook for 2016 is stable despite China slowdown and commodities and oil rout

Despite the ongoing commodities route, falling oil prices and Chinese slowdown, Moody's is optimistic, and thinks the outlook in Europe is stable for 2016.

Non-financial companies in Europe, the Middle East and Africa (EMEA) can look forward to increased consumer confidence, solid market liquidity, low default rates, and "sustained" though "slow" growth of around two per cent in Europe.

The ratings agency says there could be resurgent worries about sovereign debt in the region, but on the whole risks of renewed recession, or knock-on effects from China remain stable.

Jean-Michel Carayon, a senior vice president at Moody’s, and author of the report, said:

Many corporates have used their access to capital markets to boost cash balances and bolster liquidity. Most of the companies will also not be affected by the current growth slowdown in China and should be able to maintain stable credit metrics, despite the still low growth in Europe.”

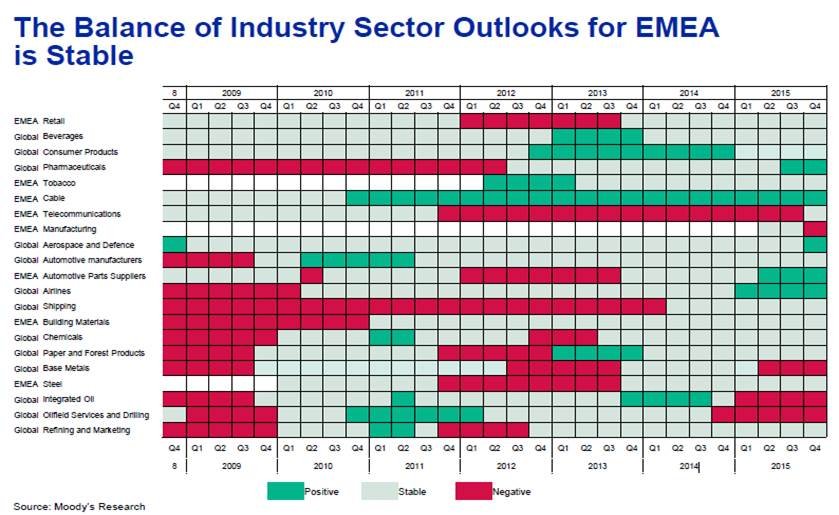

The majority of industries have a stable outlook, but low and volatile oil and commodity prices will continue to put "severe stress" on metals, mining and oilfield services.

Read more: Global M&A breaks records in 2015

While the Chinese slowdown will pressure some companies in EMEA, most will be unaffected, and Russian companies, which have been fleeing the London Stock Exchange, thanks to domestic political pressure and sanctions, will maintain sufficient liquidity, although access to international capital markets may remain constrained.

Moody's also referred to the risk from geopolitical uncertainty which could impact investor and consumer confidence, and mean the "markets are jittery [and] sentiment is more negative than a year ago."

The risks however are limited. Growth may be slow, but it has stabilised and the banking environment is less vulnerable than it was in 2011/12, the Moody's report said.

Read more: Oil sector set to shrink by a third thanks to low oil prices

China remains the strongest growth market for many European companies, and even with 6.3 per cent growth still offers far more than the US or European economies.

M&A activity is expected to be sustained into next year, fuelled by strong cash balances, which will help protect against market shocks, and wait out the recovery. Overall, the majority of sector's have a stable outlook, with positives and downsides "roughly balanced."

As for a rates rise, Moody's said there is "no risk" of a 2016 rate hike in Europe, although predicts the UK will raise interest rates in the first half of next year.