Turmoil: Analysts cut oil forecast as glut woes intensify

Citi analysts are the latest to lower their expectations for the short term future of the oil price, predicting a “very weak first quarter”.

The supply glut is now widely expected to run on well into 2016 due to Opec reiterating its dedication to unrestricted pumping, Iran charging into the market once sanctions are lifted next year and so far no drop in production in US shale and Russian output.

Citi expects the US benchmark West Texas Intermediate (WTI) to enter the high $20 mark in the near future, while international standard Brent crude will fall to around $30 a barrel.

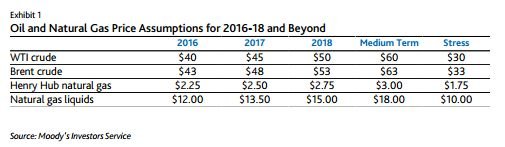

Credit ratings agency Moody’s has also significantly lowered its Brent and WTI price forecasts for 2016.

Moody's said additional production from a post-sanction Iran could offset or even exceed any slowdown in output from the United States. As such it cut its forecast for global benchmark Brent by $10 to $43 per barrel, and North American benchmark West Texas intermediate by $8 to $40 per barrel.

"Opec oil producers continue to produce without restraint as they compete for market share, exacerbating the currently saturated market," Terry Marshall, a senior vice president at Moody's, said.

"Russia has also greatly increased production, and the possibility that sanctions will be lifted on Iran in 2016 could flood the market with even more supply."

Read more: Don’t bank on global finance returning to Iran

Iran, whose oil production has been curtailed in recent years due to international sanctions, has vowed to boost supply once embargoes are lifted in March 2016.

Moody's predicts global oil demand will rise by around 1.3m barrels per day in 2016, more than its previous forecast, as oil consumption picks up in countries such as the US, China, India and Russia.

But it said that ongoing increases in Opec oil production have offset growing global demand and led to a build-up of oil inventories.

The International Energy Agency (IEA) on Friday warned that the global supply glut was likely to deepen next year, putting more downward pressure on prices. Opec failed to agree on a production ceiling at its meeting earlier this month.