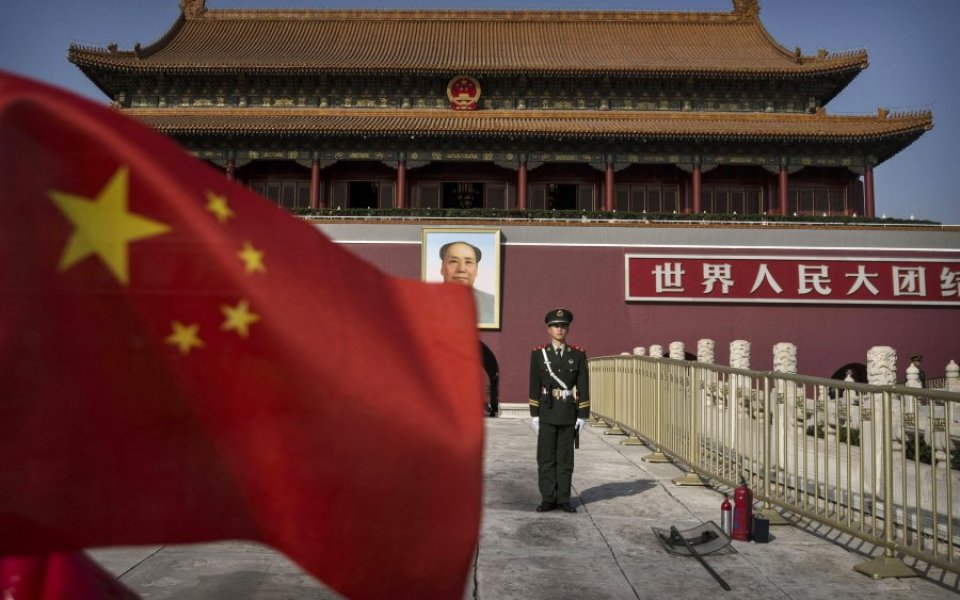

As China fears spark a global market rout, is the country the greatest risk to the world economy in 2016?

Rebecca O’Keeffe, head of investment at Interactive Investor, says Yes.

You only have to look at the reaction to yesterday’s disappointing data and subsequent global stock market rout to appreciate just how important China has become to international investors. While the US economy is still much larger, relative growth rates mean that China is actually contributing far more to overall global growth than the US. Based on estimated growth rates of “only” 6.9 per cent in China and 2.5 per cent in the US, China delivered almost 30 per cent of total world economic growth in 2015, compared to a 17 per cent contribution from the supposedly “healthy” US. The threat of a further slowdown in Chinese growth is, therefore, of fundamental importance to global markets, and should not be underestimated. China has already demonstrated its dominance of commodities and basic goods markets and is now attempting to expand its reach into the service and higher technology sectors. Investors who fail to appreciate the changing landscape and the significance of China’s increasing role in the global economy do so at their own peril.

Adrian Lowcock, head of investing at Axa Wealth, says No.

Concerns over Chinese growth have become a regular feature of stock market commentary. Few believed the high growth figures that were coming out of the country, yet markets were shocked last year when more realistic data was forthcoming. Given the size of China’s economy, it was no longer realistic to expect 7 per cent annual growth year in year out. Indeed, it is now less about the rate of growth and more about the quality of that growth. Chinese stock markets are likely to remain volatile as this transition occurs and, in the short term, weak data will impact on global markets. However, investors are fully aware of the challenges facing the country, and much of this is factored into markets. China will play an important role in 2016, but it is rarely the known issues which pose the greatest risks to investors. It is the unknowns or unexpected – further political upheaval in the Middle East, for instance, or a surprise election victory in the US could cause greater upset as they will catch all investors unprepared.