A bad start to the year for Sainsbury’s, Anglo American, Aberdeen Asset Management and Burberry, who top the list of most shorted shares of 2016

Sainsbury's yesterday revealed it had made an approach to takeover Home Retail Group, the owner of Argos and Homebase, in a bid to reverse its faltering fortunes.

The report came as the extent of the Big Four supermarket’s woes were laid bare by new data revealing that its shares were the most shorted on the FTSE 100.

Short selling is effectively betting a company’s share price will fall. An investor borrows shares in order to sell them at a pre-arranged price later, thereby making a profit when the price falls. Short interest is the number of shares sold short as a percentage of total shares held, or shares outstanding.

Sainsbury’s has a short interest of 17 per cent, a one per cent fall from the last month, with 327m shares on loan.

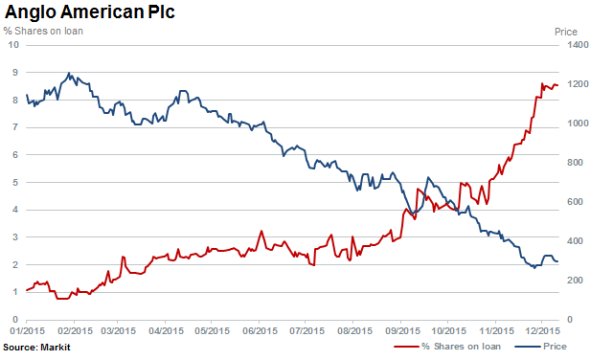

Beleaguered miners Anglo American and Glencore were also in the top 10 shorted companies, with 8.6 per cent and 5.6 per cent of shares out on loan respectively. There was a 34 per cent

increase in short selling interest in Anglo American shares from the month before.

Aberdeen Asset Management, Burberry, Rolls Royce and Tesco were also on the most shorted list.

On the FTSE 250, Ocado was one of the most successful shorts, with a short interest of 12.7, a four per cent rise, as investors weigh the possible disruption Amazon could wreak on the market.

Short sellers increased their positions in the miners in light of the Chinese market turmoil, sparked by weaker manufacturing data. There was a 34 per cent increase in short selling interest in Anglo American shares from the month before.

Aberdeen Asset Management, Burberry, Rolls Royce and Tesco were also on the most shorted list.

On the FTSE 250, Ocado was one of the most successful shorts on the first day of trading, with a short interest of 12.7, a four per cent rise, as investors weigh the possible disruption Amazon could wreck on the market.

Home Retail Group is the sixth most shorted company, with 9.5 per cent of its shares out on loan, leaving many hedge funds sitting on losses after its dramatic 34 per cent share price jump.

According to the Financial Conduct Authority the hedge funds betting against the Argos-owner include London-based Marshall Wace, which sold 0.52 per cent of the company's shares, Immersion Capital, Newbrook Capital Advisors, WorldQuant, JP Morgan Asset Management, UBS Global Asset Management, and Odey Asset Management, which sold short 2.18 per cent of the group's shares and is faced with the biggest losses for the day.