Deceptive demographics: Attitude matters more to marketers

Here's a shocker for you. There are actually 19 year-old guys who watch Dance Moms, and 73 year-old women who watch Breaking Bad and Avengers,” Netflix’s Todd Yellin told the SxSW conference in Texas last year.

Marketers have long recognised the limitations of segmenting consumers demographically. Finding out a customer’s age and gender data, Yellin argued, is “almost useless”. Digital advertising and first-party data has been providing brands with more material. But knowing the best way to segment and categorise those consumers – harnessing that knowledge to increase market share – is a harder task.

“Consumers’ attitudes are three times more likely to predict their behaviour than their demographic make-up,” says David Pritchard, client development director at Network Research. His firm has been looking for hidden patterns in the psychographic profiles of consumers and potential brand advocates, so that digital advertisers can target more effectively. A number of the results are surprising.

For example, the mobile-first generation – those who primarily use phones and tablets to access the web – are not just interested in digital and tech brands. Indeed, Network Research found that this group engages more closely than the average consumer with traditional service-led brands across a range of sectors. Twenty-one per cent of mobile-firsters were found to be advocates of British Gas, with even more (24 per cent) advocating BT. This is significant for marketers, given the amount of time this group spends online, where advertising can reach them easily.

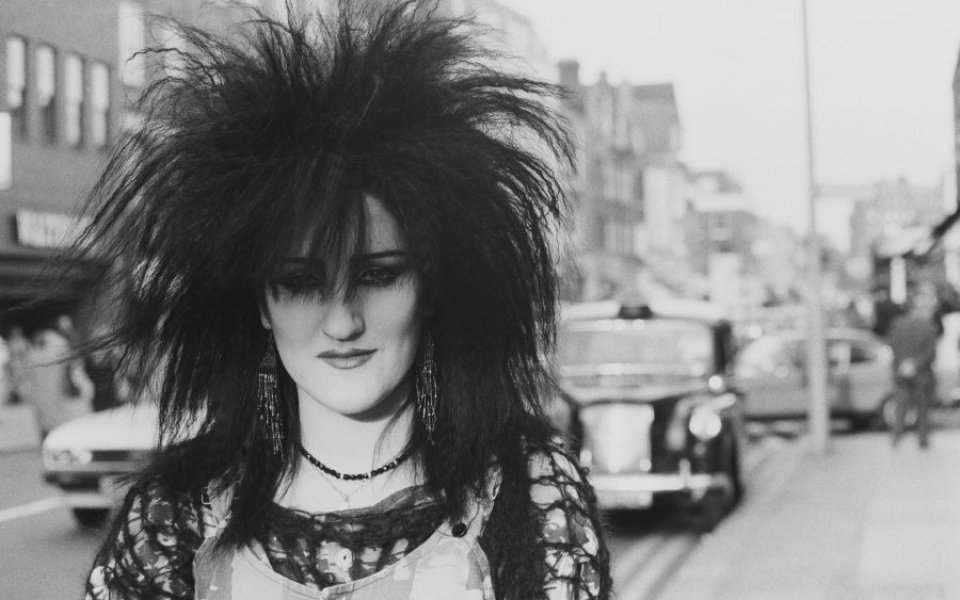

Fashion-conscious and early-adopter audiences, traditionally associated with the urban 18-24 year-old demographic, are also being unfairly pigeon-holed as “selective and fickle”, argues Pritchard. They too use and advocate a wide range of brands in various categories.

There are certain attitudes shared by one sub-group of consumers which should raise red flags for marketers, because they predict a poor level of engagement with brands in general. “There is a thread of conservatism which runs through this consumer subgroup, tying together such attitudes as strong views on politics, data privacy, work-life balance and the environment,” says Pritchard. These people don’t come from any particular demographic group, and crucially, they aren’t big consumers, or interested in having relationships with brands.

In November, Network Research reported that one demographic criterion – being parents – is still significant for marketers. Those with children are much more likely to recommend certain brands, like Samsung or M&S. Despite its positioning as a low cost retailer, Primark was as likely to be recommended by more affluent consumers (social grade AB) as by the lower middle class (social grade C1).