Holland & Barrett tells suppliers to foot the bill for company’s investment programme by reducing costs

Healthfood retailer Holland and Barrett has urged its suppliers to slim down their costs by five per cent to help fund the company's pension scheme.

In addition to the price cuts, the group wants its suppliers to foot the bill for its investment in security by paying for £3m-worth of security tags and high definition CCTV in the form of invoice adjustments and/or free stock, the BBC first reported.

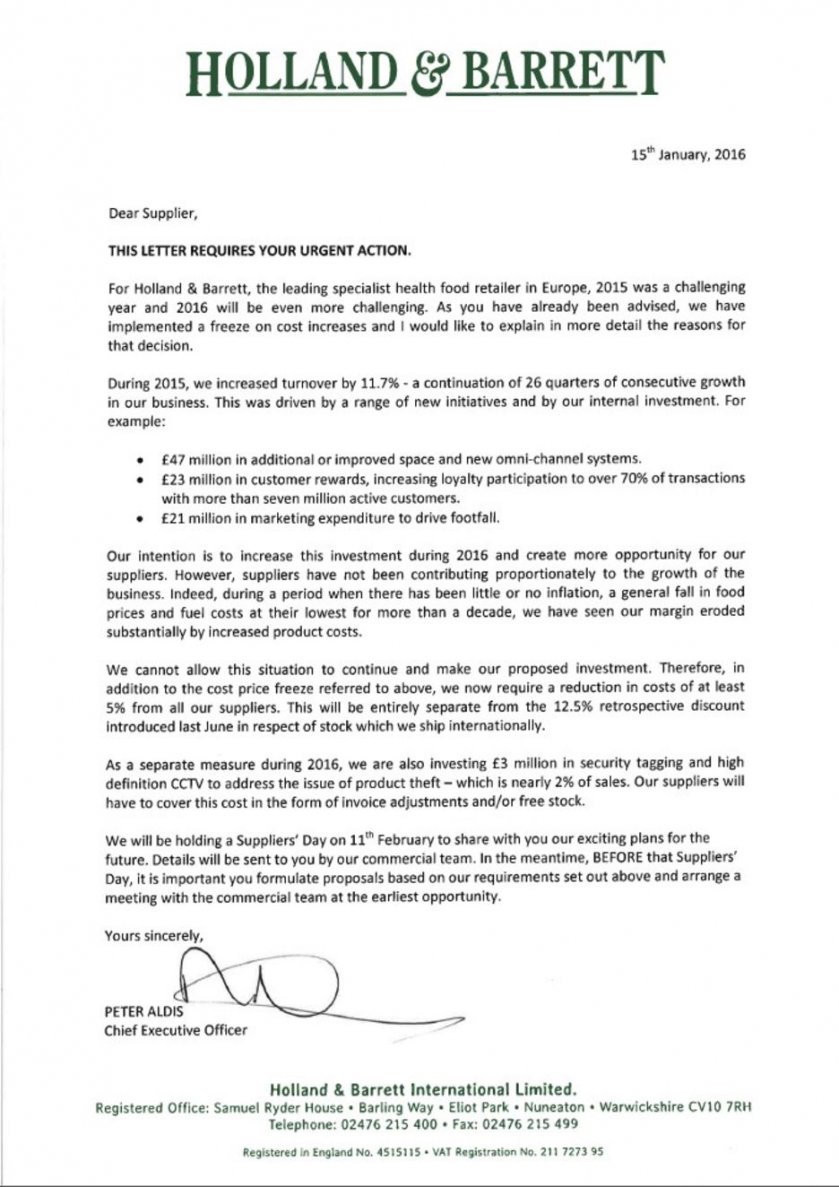

In a letter to its suppliers, Holland and Barrett chief executive Peter Aldis, said:

Suppliers have not been contributing proportionately to the growth of the business.

"During a period when there has been little or no inflation, a general fall in food prices and fuel costs at their lowest for more than a decade, we have seen our margin eroded substantially by increased product costs," he said in the letter, explaining why the retailer had introduced a freeze on cost increases. He went on:

We cannot allow this situation to continue and make our proposed investment. Therefore in addition to the cost price freeze referred to above, we now require a reduction in costs of at least five per cent from all our suppliers. This will be entirely separate from the 12.5 per cent retrospective discount introduced last June in respect of stock which we ship internationally.

The letter seen by the BBC

The letter seen by the BBC

Holland and Barrett is owned by US private equity firm The Carlyle Group. Last year it increased its profits by 12 per cent to £146m.

In a statement to the BBC, Holland and Barrett said:

"Suppliers benefit from the resultant increase in sales this growth brings, as well as customer and brand reach. This latest initiative is not the start of a negotiation process but a further part of this growth strategy which we are now in the process of communicating to our suppliers."