Shell confident BG deal will get rubber stamped as investors asked to vote on Wednesday

Royal Dutch Shell and BG Group shareholders will vote this week on whether to approve the proposed tie-up between the two companies.

The acquisition is widely expected to go through, needing 50 per cent approval from Shell shareholders and 75 per cent from BG, though there has been speculation that the falling oil price would derail the deal. Shareholders will vote on 27 and 28 of January.

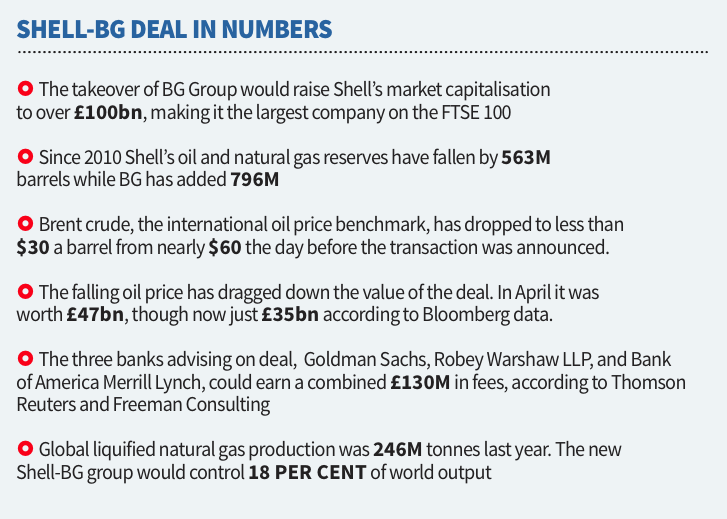

Shell made a £47bn offer for BG in April last year, and the price of oil has since almost halved, falling from $55 to around $30 per barrel.

Influential shareholder advisory firms PIRC, Institutional Shareholder Services, and Glass Lewis have also urged shareholders to approve the deal. PIRC told shareholders: “[Shell] states that the success of the deal does not depend on short term oil prices. The Company expects the value to be delivered over 15 years.”

David Cumming, head of UK equities at Standard Life, a major shareholder in both Shell and BG, told the BBC he doesn’t think the deal makes financial sense with the oil price so low, calling it “value destructive for Shell shareholders” due to a weak outlook for oil prices and risks related to BG's assets in Brazil.

Cumming is expected to vote for the deal with his BG holding and against it with his Shell holding.

He has called for the deal to be renegotiated to take into account the drop in the oil price.

Standard Life is so far the only major shareholder to speak out against the deal however.

Norway’s Norges, the world’s biggest sovereign wealth fund and a top five shareholder in both Shell and BG, last week said it is planning to vote in favour of the takeover.

The Qatar Investment Authority, a major Shell shareholder, is also reportedly in support of the deal.

Last week Shell said it was expecting a sharp drop in its fourth quarter profits, falling to between $1.6bn and $1.9bn from $4.2bn in the same period last year.

Shell said it is expecting to cut costs by a further $3bn this year, on top of the $4bn it trimmed from its operating costs in 2015.

The firm is expected to axe 10,000 staff if the deal with BG Group goes ahead.