Funds under management reach a record high of £871 billion despite the commodity rout and uncertainty over China’s economy

Funds under management reached a record £871bn in 2015, up from £835bn the year before, according to the latest data from the Investment Association, the investment managers trade body.

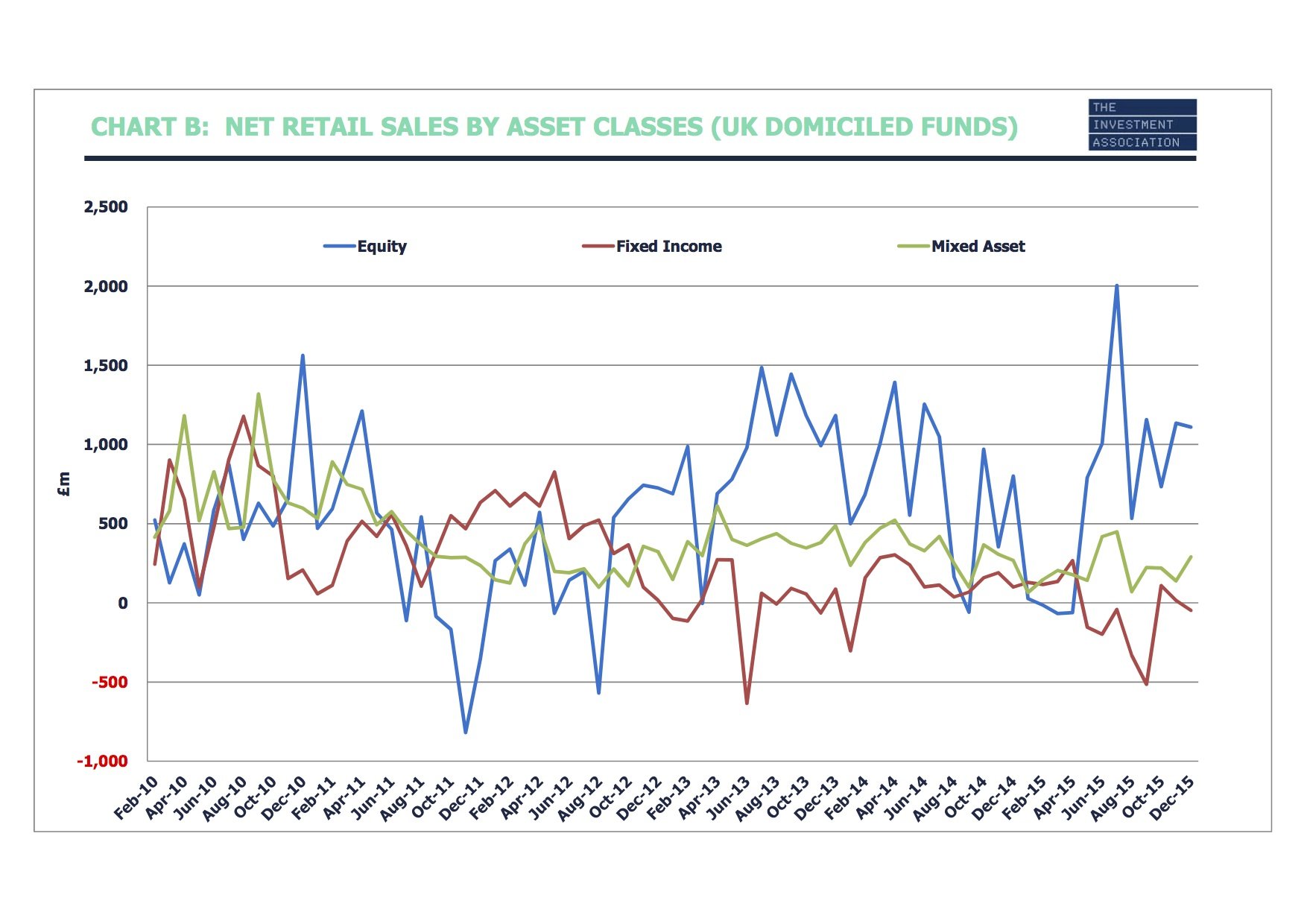

Equities were the best-selling asset class for the second consecutive year, with sales to retail investors of £8.4bn. UK equities did particularly well, with net retail sales worth £4.3bn.

Property was the second best-selling with net retail sales of £2.7bn, down from £3.8bn in 2014.

Tracker funds also had a record year, with retail sales of £5.4bn, and an all time high for funds under management of £108bn. Fixed income funds saw a record net retail outflow of £519m in 2015 (investors leaving funds), compared to a net retail inflow of £1.5bn in 2014.

Fixed income funds saw a record net retail outflow of £519m in 2015 (investors leaving funds), compared to a net retail inflow of £1.5bn in 2014.

Interim chief executive of the Investment Association, Guy Sears, said:

Despite market uncertainty surrounding China, commodity prices and central bank interest rate policy throughout 2015, we saw funds under management of authorised investment funds hit an all-time high of over £870 billion.

After a slow start, net retail sales bounced back in the final three quarters of the year with investors favouring equity products, particularly European funds and those with an income focus.

European funds were the best-selling, with record retail sales of £4.5bn, up from £221m last year. UK funds came third, with retail sales of £1.9bn, down from £5bn. Global funds also saw sales fall, to £2.2bn from £3.2bn.

Perhaps unsurprisingly, Asian equity funds were the worst-selling, with record outflows from retail investors of £867m, from inflows of £53m. North American funds also saw outflows, of £364m.