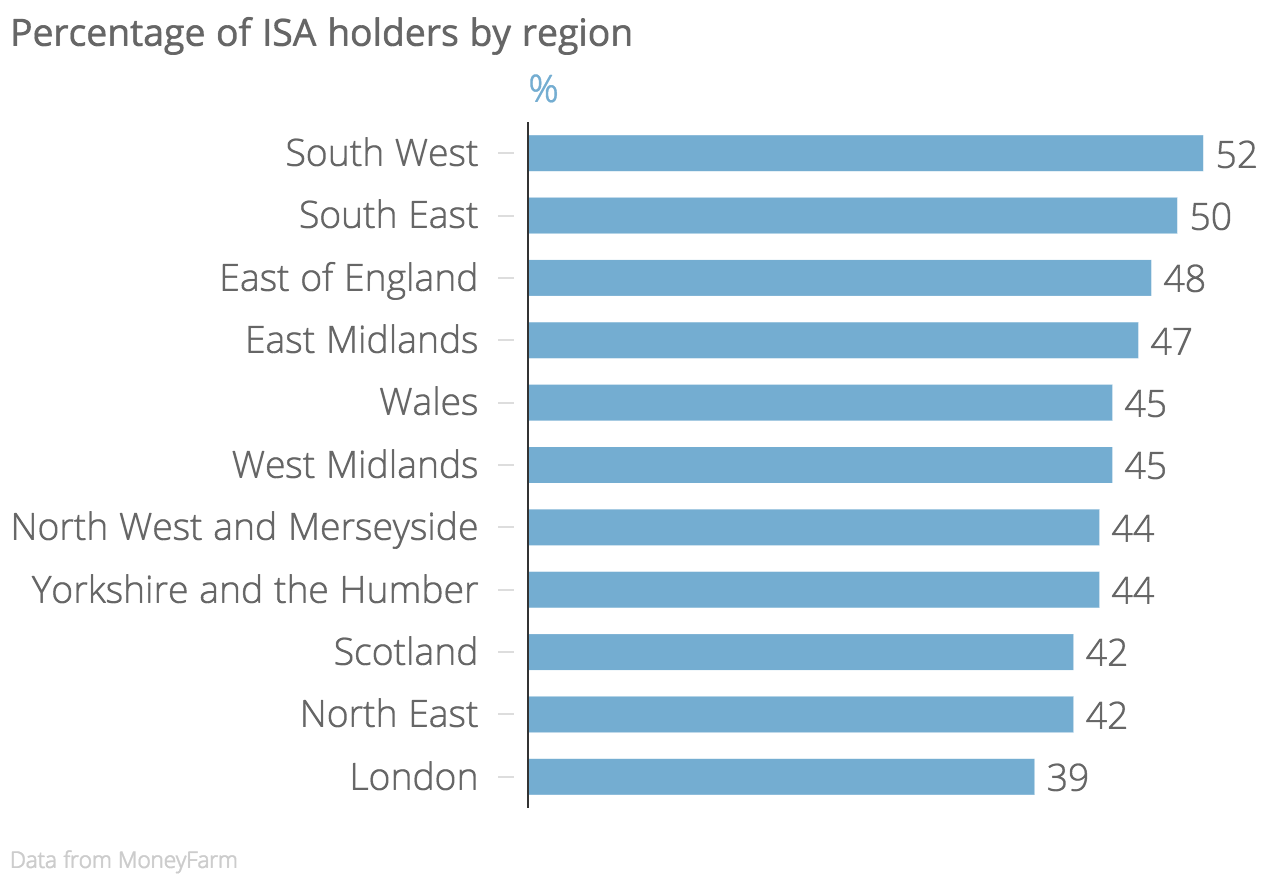

Londoners least likely to own an ISA, but the savings product proves more popular in the south west

Londoners have a bit of a reputation for trying to have it all, but, when it comes to savings and investments, it appears there's one thing they're routinely passing on.

According to research released this weekend by wealth management service MoneyFarm, just 39 per cent of capital dwellers have an ISA, despite gross disposable household income in London being more than a third (36 per cent) higher than the UK average.

By comparison, 44 per cent of adults across Great Britain have savings stashed in an ISA, while the product is proving particularly popular in the south west, where more than half (52 per cent) own an ISA.

When asked why this regional divide existed, Paolo Galvani, chairman and co-founder of MoneyFarm, said it could be because those in the capital are just too busy to put up with the paperwork.

"Unfortunately, the process in setting up and running an investment account in the UK can be so laborious and frustrating that it puts off many people from even bothering," said Galvani.

However, Galvani also added that Londoner's relative youth could also be playing a factor, as the average age of the London population is six years below that of the UK.