Londoners won’t be free of credit card and mortgage debt until they are 77, survey finds

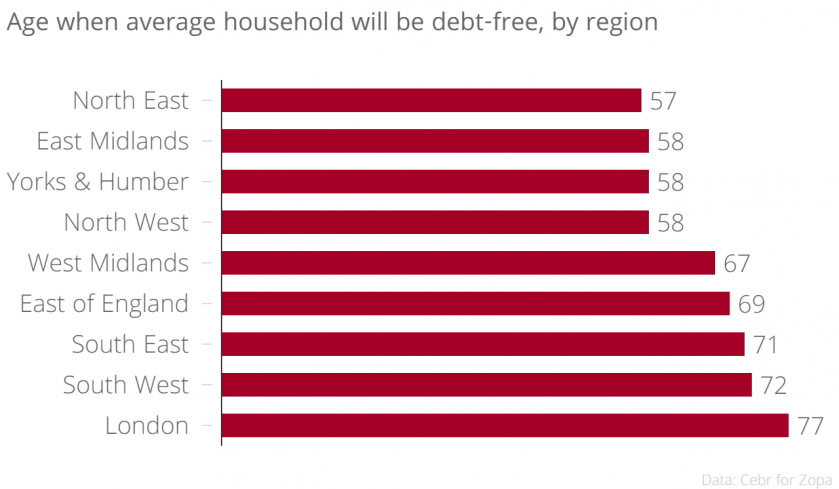

Londoners may have to wait until they reach 77 to live debt-free, according to new research.

The average Brit will not pay off unsecured debt, like credit cards and certain loans, until they are 64, a survey by the Centre for Economics & Business Research (Cebr) for peer-to-peer lender Zopa found.

That rises to 69 once mortgages are included.

Londoners are saddled the longest as they typically take on more unsecured debt and secure mortgages later, despite their higher wages.

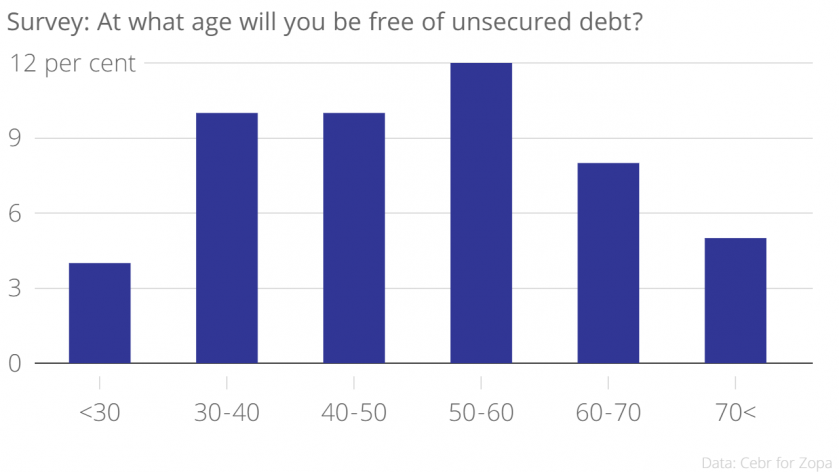

The survey also found a big gap in expectations: Britons expect to start a debt-free life when they hit 57 – 12 years earlier than they are likely to.

Those aged 16 to 24 are the most optimistic – they expect to be rid of unsecured debt at just 38.

That also makes them wildly wrong: if they buy a home with a mortgage they’ll be waiting until age 74.

Zopa executive chairman Giles Andrews said there were plenty of reasons why people were overestimating how quickly they could repay.

“One is that younger generations are guided by the experience of older ones, as people used to become debt free earlier in life as they owed less,” he said.

The average British debt per household was £53,904 in December including mortgages, according to the Money Charity.

That works out at £28,891 per adult, which is 112 per cent of average earnings.

Based on December’s figures, Brits each spend an average of £1,037 on interest repayments every year –four per cent of a typical salary.

Cebr’s research found that almost three in 10 people find paying off unsecured debt a struggle, while a fifth said it gave them sleepless nights.

A sixth said they were scared of answering their door or phone because of creditors.