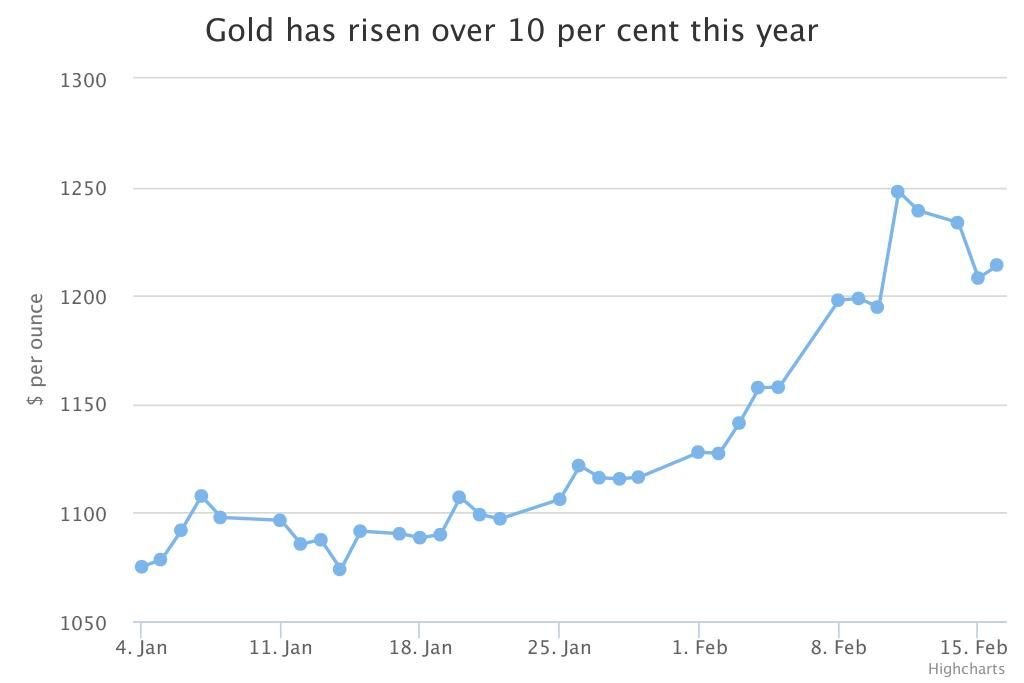

Gold price rally returns as it snaps two-day losing streak

The gold price rally returned today, ending a two-day losing streak, as ongoing concerns over the global economy returned a sparkle to its safe-haven status.

Spot gold rose 0.38 per cent to $1,213.95 an ounce in mid-afternoon trade. Earlier, it had fallen as low as $1,190.40, having shed 2.3 per cent yesterday, its biggest one-day loss since mid-July.

The precious metal has gained over 10 per cent this year as worries of negative interest rates and their impact on the banking sector, pushed investors to seek a safer alternative to stocks.

Downward pressure also came from investors cutting expectations for the number of interest rate rises from the US Federal Reserve this year. The prospect of higher US rates was a key factor driving gold prices losing 10 per cent last year.

"It's really all about confidence here – confidence in the Fed, confidence in the PBOC, confidence in the ability of financial markets generally to withstand the kind of stress that they're under," ICBC Standard Bank analyst Tom Kendall said.

"To get gold to make sustainable gains above $1,250 and up towards $1,300, you do need that sense of fear and concern more widely to be sustained, and for assets like equities to come under even more stress."

But Wall Street stalwart Goldman Sachs recommended shorting gold, saying that the fear-induced rally has been overdone.

"Fears around China, oil and negative interest rates have likely been overstated in the gold price and other financial markets," it said in a note yesterday.