Seven years of quantitative easing and 0.5 per cent interest rates by the Bank of England: Who are the winners and losers?

This Saturday will mark seven years since the Bank of England enacted its historic quantitative easing programme, and cut the UK’s main interest rate to 0.5 per cent, in a bid to save it from the financial crisis which was then tearing across the globe.

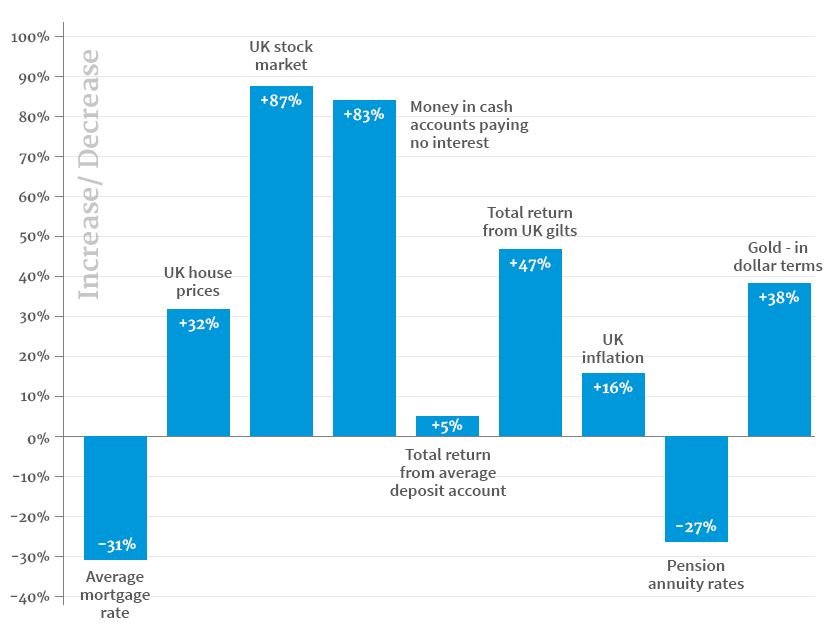

Just like any other policy, it has thrown up winners and losers. Investors who piled into stocks, bonds and property would’ve enjoyed rip-roaring rises during this period – however, pension annuity rates have fallen dramatically.

The era of ultra-low interest rates has seen cash savers lose out on £160bn in interest payments, or £6,000 per household, according to the research by financial services group Hargreaves Lansdown. In a reversal of today’s trend, they’ve also been squeezed by increased living costs, with inflation rising 16 per cent during this period.

On the flipside, borrowers have enjoyed low mortgage rates, whittling down the size of their monthly repayments. Hargreaves Lansdown said mortgage rates averaged 3.4 per cent since March 2009, compared with an average of 5.8 per cent in the previous 10 years.

“Overall, borrowers and investors have had the best of it since QE started in the UK. Mortgage costs have fallen significantly from pre-crisis levels, but this positive effect is laced with an underlying risk,” Laith Khalaf, senior analyst Hargreaves Lansdown, said.

“If borrowers get too comfortable taking on high levels of debt at low interest rates, they could be in for a nasty shock if and when rates rise.”

Click or tap on the chart to see it in a new screen

Note: Hargreaves Lansdown also estimates interest lost by savers from September to be £160bn

Note: Hargreaves Lansdown also estimates interest lost by savers from September to be £160bn