Consumer goods groups challenge financials to become biggest sector in FTSE 100 as Barclays, HSBC, RBS and Standard Chartered share prices plummet year-to-date

Consumer goods groups are challenging the dominance of financial firms in the FTSE 100 for the first time in a decade.

The two sectors are neck-and-neck, with consumer goods actually overtaking financials briefly during February, rising to account for 20.85 per cent of the FTSE 100, compared with 20.61 per cent, before slipping back down again.

As at 1 March, there was just 0.15 percentage points between the two sectors, with the 24 financial firms in the blue chip index accounting for a 28.89 per cent weighting, while 14 consumer goods businesses accounted for 20.74 per cent. Oil and gas was third with just 12.33 per cent.

A decade ago, financials made up 27.76 per cent of the index, while consumer goods was in fifth place with just 9.32 per cent of the total. Oil and gas was second, accounting for 19.86 per cent.

Read more: British economy needs a vibrant banking sector

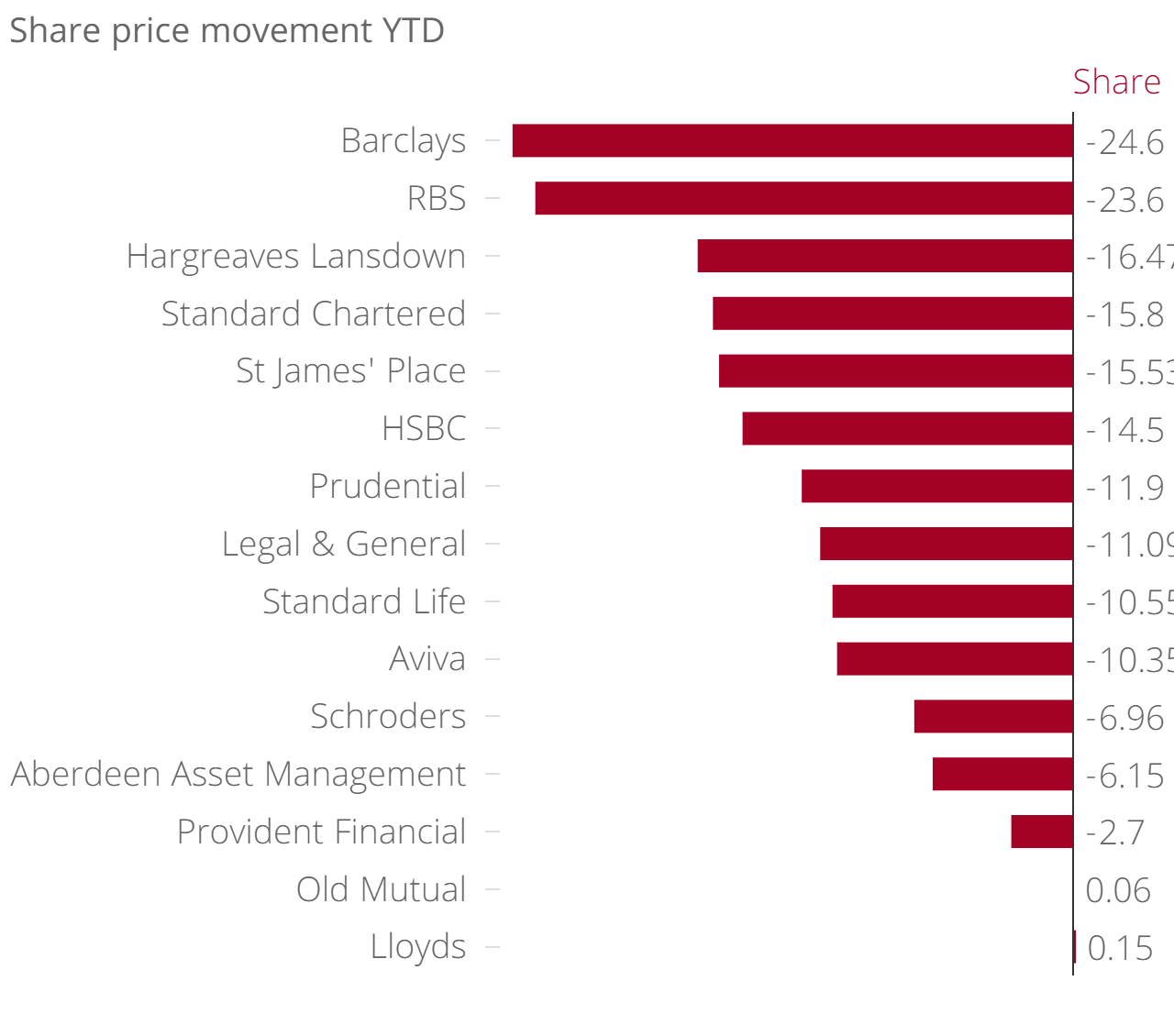

It has been a brutal start to the year for banks, with the likes of Barclays, Standard Chartered, HSBC and Royal Bank of Scotland's share prices all tumbling in the first couple of months of 2016.

Barclays's share price is currently down 24.6 per cent since the start of the year, while RBS was down 23.6 per cent, Standard Chartered was down 15.8 per cent and HSBC was down 14.5 per cent.

That compares with the FTSE 100's drop of 1.1 per cent.

It comes as Sports Direct, whose share price has plummeted 27 per cent since the start of the year, and Aberdeen Asset Management, which is down 6.1 per cent, are due to be booted out of the blue chip index.

They are to be replaced with Morrisons – which is up 40 per cent – the newly combined Paddy Power Betfair and hospital group Mediclinic International.

Russ Mould, investment director at AJ Bell, said: “Morrisons’ return could serve to draw further attention to one of the market’s most intriguing trends so far in 2016 – the apparent return to favour of the food and drug retailing sector.

“As of 29 February, food and drug retailers ranked as the top-performing sector in the FTSE 100 so far this year, after ranking 37th, 34th, dead last and then 32nd out of 39 over the past four years.

“Whether this proves to be no more than a dead-cat bounce remains to be seen, especially as Amazon, Aldi and Lidl seem determined to keep the pressure on the UK’s Big Four grocers, but perhaps someone, somewhere feels there is value to be had – or at least that a lot of bad news is now factored into earnings and dividend forecasts after a torrid five-year spell of downgrades and cuts.”