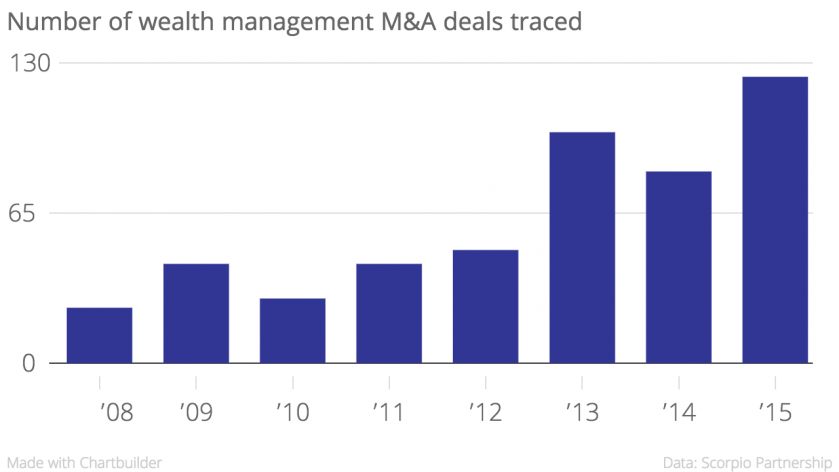

Wealth management M&A deals up nearly 50 per cent in 2015, according to new report

Wealth management M&A deals grew by nearly 50 per cent last year, according to a new report.

Scorpio Partnership’s annual M&A assessment reported there were 124 deals reached in the sector last year.

This was the highest figure recorded in the eight years the tracking assessment has been carried out – up from 83 in 2014 and 100 in 2013.

But Scorpio said the level of assets under management (AUM) acquired in 2015 fell, with activity concentrated on smaller wealth managers.

Read more: Here's why 2015 has been such a bumper year for M&A

The report said $408.5bn (£290.5bn) worth of assets changed hands in 2015, compared with $461.4bn in 2014.

Sebastian Dovey, managing partner at Scorpio, said: “Looking closer at the deals concluded it is clear that a much higher number of deals took place among the much smaller wealth managers.

"Notably, the volume of AUM changing hands is substantively down from 2013 when $780bn was traded.”

The report also noted that deal valuations rose marginally from 2.06 per cent to 2.14 per cent of price at AUM. It said businesses with AUM between $5bn and $10bn “commanded the best multiples relative to the market”.

In the UK, Scorpio traced 49 deals with the acquirer from the UK – down from 54 in 2014. And it found 51 cases in which the target was UK-based, flat on 2014.