How currencies move stock markets

Many factors move stock markets but the strength of a country’s currency can have a surprisingly large bearing.

Several high profile events have underlined this in the past year – most notably Brexit and Donald Trump’s US election win.

The way currencies affect stock markets are different in each country.

Rising currencies may serve to help share prices in one country and hinder them in another. It largely depends on where companies in a country make their money – home or abroad?

We look at three examples in the US, UK and Asia.

How the US dollar moves the S&P 500

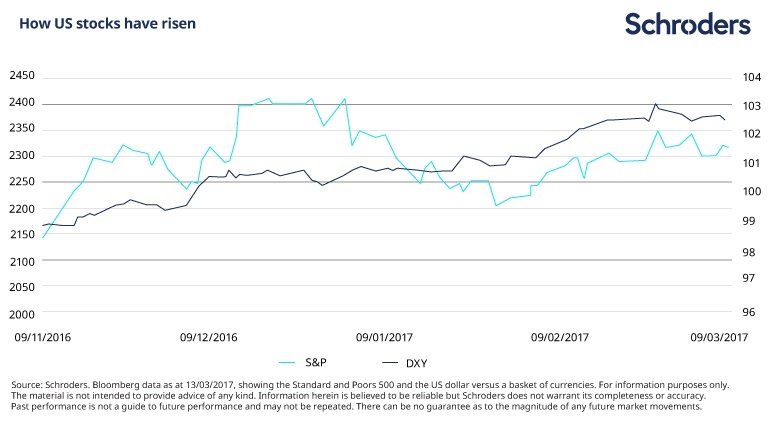

Donald Trump’s election as US president caught some investors by surprise, but after an initial wobble US stocks rallied.

The S&P 500, the benchmark US share index, rose 10% to new all-time highs in the month following Trump's election on 9 November.

There are many factors that can influence stock markets, but the strength of the US dollar, which gained 3% during the same period, was a key driver.

Trump’s election on the back of “America first” policies, which included encouraging US businesses and consumers to “buy American” and huge infrastructure spending plans, raised inflation expectations and the prospect of interest rates rises.

Higher interest rates can mean higher rates of return and this makes currencies more attractive to investors. Then in turn, a stronger dollar supports the earnings of US companies that generate most of their revenues in the US, providing the currency doesn’t become strong enough to hurt export demand.

Despite some weakness in December 2016 the US dollar has continued to strengthen following Trump’s election.

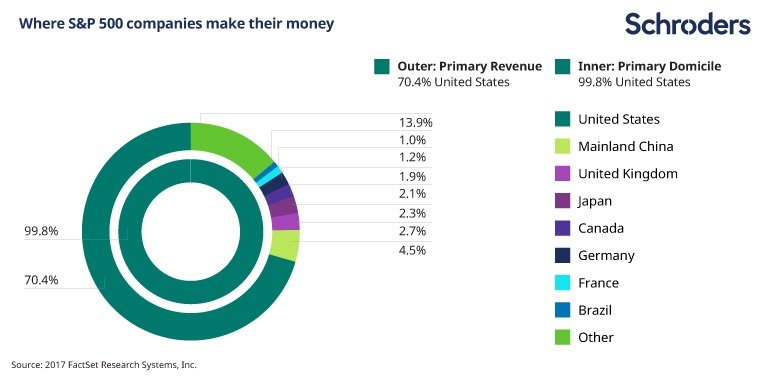

As the chart below illustrates, more than 70% of the revenues generated by US companies listed on the S&P come from the US. France is next biggest contributor, followed by the UK.

The inner ring illustrates that 99.8% of the companies on the S&P 500 have registered head offices (i.e. they are domiciled) in the US.

The outer ring is the important part. It shows the regions from which S&P 500 companies generate their revenues. All but 29.6% are generated inside the US.

How sterling moves the FTSE 100

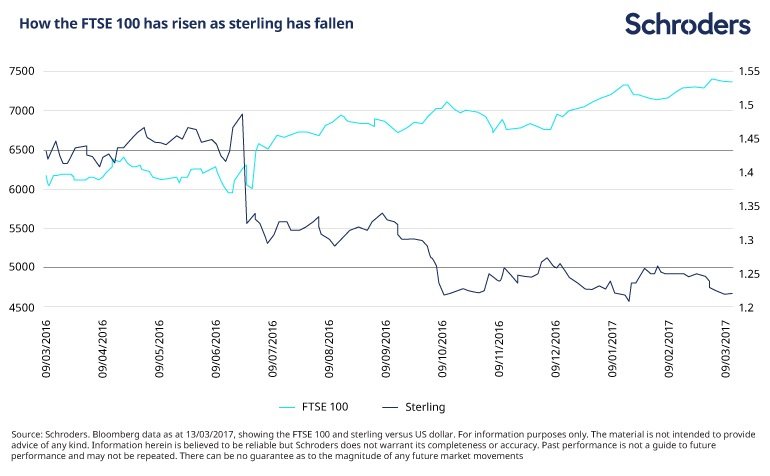

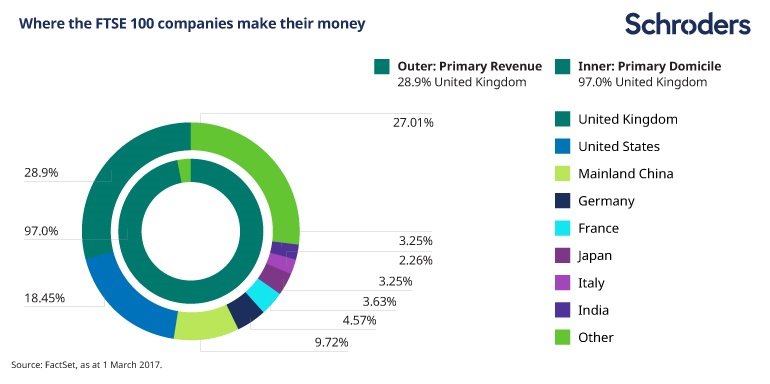

In contrast to the S&P 500, the majority of FTSE 100 companies generate their revenues from outside the UK.

So, when the Brexit decision sent sterling tumbling the FTSE 100 rose sharply. In the three months following Brexit, the index rose 10.4%, while the pound fell 12.8% against the dollar. Why is this?

The majority of FTSE 100 companies receive their revenues in foreign currency. This money is worth more when converted back into pounds when sterling is lower.

Consider a simplified scenario of currency movement. If the exchange rate was $2 to the pound then every $1,000 of revenue would be worth £500.

However, if sterling weakened and the exchange rate moved to $1.50 to the pound, then every $1,000 of revenue would be worth £667. The outcome is that revenues increased 33% as a result of the fall in sterling.

As the chart below shows, 71% of revenues generated by FTSE 100 companies come from outside the UK.

The strength of sterling against the euro is also important given the large chunks of revenue accounted for by France, Germany, Italy and other eurozone countries.

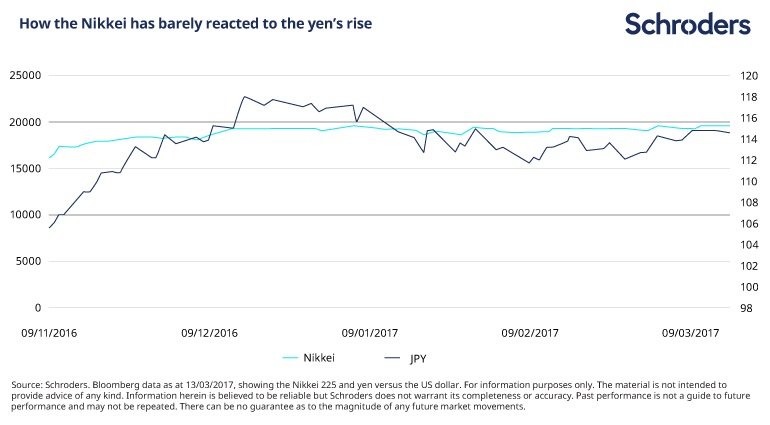

How the Japanese yen moves the Nikkei 225

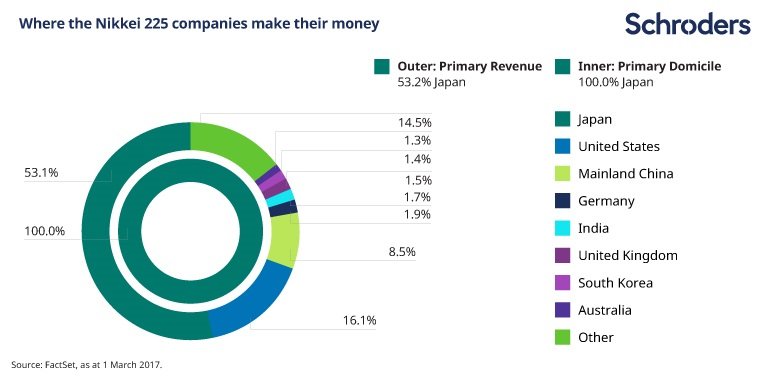

Revenues from Nikkei 225 companies are more finely balanced and therefore currency movements tend not to have such a dramatic effect on the stock market.

As the chart below shows, 53.2% of revenues generated by Nikkei 225 companies come from inside Japan.

Why revenue exposure is important for diversification

Imagine you are a US investor investing in a company listed on the FTSE 100 to diversify your portfolio away from the US.

It is understandable that you might expect that you are gaining exposure to the UK market, its currency and the benefits of its economy.

But there is a real chance that the company you are investing in could be generating most of its revenues and profits from the US. In reality you would not be diversifying your portfolio at all.

Currency moves are by no means the main reason why stock markets rise and fall but they are important depending on which regions listed companies are exposed to. It is something that investors might consider when building a diversified portfolio.

- Find more Schroders insights on our website and follow us @schroders

Important Information: The views and opinions contained herein are those of David Brett, Investment Writer, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.