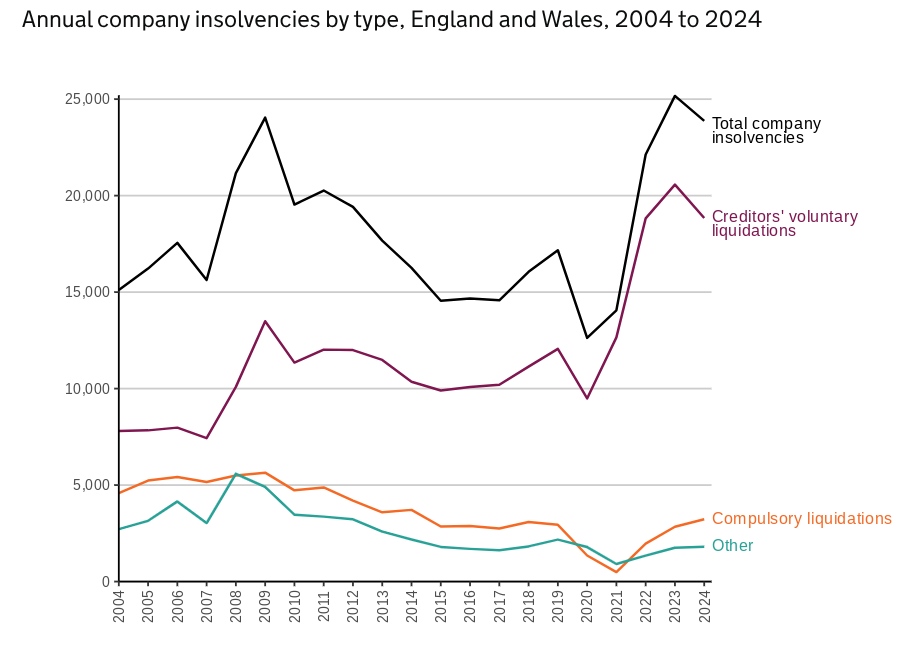

UK economy: Compulsory liquidations hit 10-year high

The number of compulsory liquidations hit its highest level since 2014, according to new figures, as firms continued to grapple with high costs and a sluggish economic environment.

Figures released from the Insolvency Service showed that there were 3,320 compulsory liquidations in 2024, the highest number for 10 years and a 14 per cent increase on the year before.

A compulsory liquidation is a process through which a company is forcibly closed down when it fails to meet its obligations.

The figures indicate that the stress facing businesses from a combination of higher costs, elevated borrowing costs and weak demand remains acute.

“Compulsory liquidation levels have increased compared to last year as creditors pursue the debts they are owed in an effort to balance their own books,” Tim Cooper, president of R3 said.

While compulsory liquidations increased, the total number of insolvencies dropped five per cent on the 30-year high recorded in 2023, thanks to a seven per cent decrease in creditors’ voluntary liquidations (CVLs).

Source: Insolvency Service

CVLs are mostly used by business owners to close redundant companies with no ongoing business and make up the vast majority of total insolvencies.

Despite the decrease, most analysts were reluctant to suggest that the number of insolvencies would be a stable downward trend.

Jeremy Whiteson, restructuring and insolvency partner at Fladgate, said the figures might just prove to be a “temporary relaxation”.

“Whether the impact of the continuing business challenges results in a subsequent uptick in figures will only be seen over a longer time period,” he said.

In particular, a number of commentators warned about the potential impact of the looming increase in the minimum wage and hike to employers’ national insurance .

Analysis from PwC suggests that the retail sector was the worst hit in December, with insolvencies rising 30 per cent month-on-month.

Failures in the manufacturing sector were also up by over 25 per, according to the firm’s research.

“Christmas trading was subdued for many businesses, and we would expect to see an increase in insolvency filings in January and February as companies take stock of their results and look toward impending tax changes in April,” David Kelly, head of insolvency at PwC UK said.