‘Wealth the new work’: Wealth inequality ‘undermining capitalism’

An influential think tank has urged the government to go further in tackling the growing impact of wealth inequality on the UK economy.

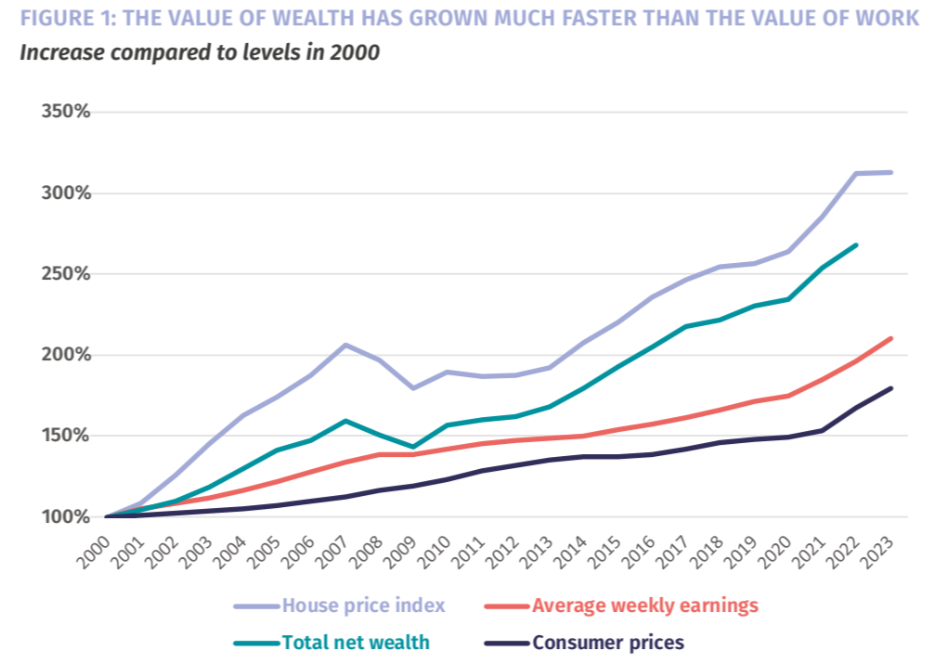

A new report from the Institute for Public Policy Research (IPPR), which has close links to the new government, shows that house prices have more than tripled since 2000, while individual employee earnings have only doubled.

“For most, your house has outvalued you this century – making wealth the new work,” Parth Patel, associate director of at the IPPR, said.

The increasing importance of wealth relative to income means that the divide between those who are wealthy and those who are not is in danger of becoming increasingly embedded.

The report noted that rising house prices have made it increasingly difficult for people to get onto the housing ladder.

As a result, the share of 35-64 year-olds in private rented accommodation has almost tripled over the past 20 years, while it has almost doubled for 25-34 year-olds.

The report also pointed out that inheritances received by those born in the 1960s represented a boost worth eight per cent of average lifetime earnings, which is projected to rise to 14 per cent for those born in the 1980s.

Among the 1980s cohort, one in six are in line for an inheritance worth more than 10 years’ worth of average earnings.

“Those on the wrong side of this divide can no longer catch up by putting in longer shifts,” Tom Clark, author of the report said. “Economic progress and financial security now depend relatively more on inherited wealth and relatively less on individual work.”

Patel said the concentration of wealth “runs against the basic principle of capitalist democracy: hard work pays off”.

The IPPR called for wealth to be taxed more effectively, particularly forms of wealth which arise primarily from scarcity, but it also urged policymakers to think more broadly about public policy designs in an economy increasingly defined by private wealth.

The think tank recommended strengthening safety nets for low-wealth households, for example through affordable housing and affordable adult social care. It also suggested that policies needed to support wealth derived from productive and sustainable assets, which could help facilitate economic growth.