Inflation falls below two per cent for first time since April 2021

Inflation fell further than expected last month, dropping below the two per cent target for the first time since April 2021 in a further boost for the Bank of England.

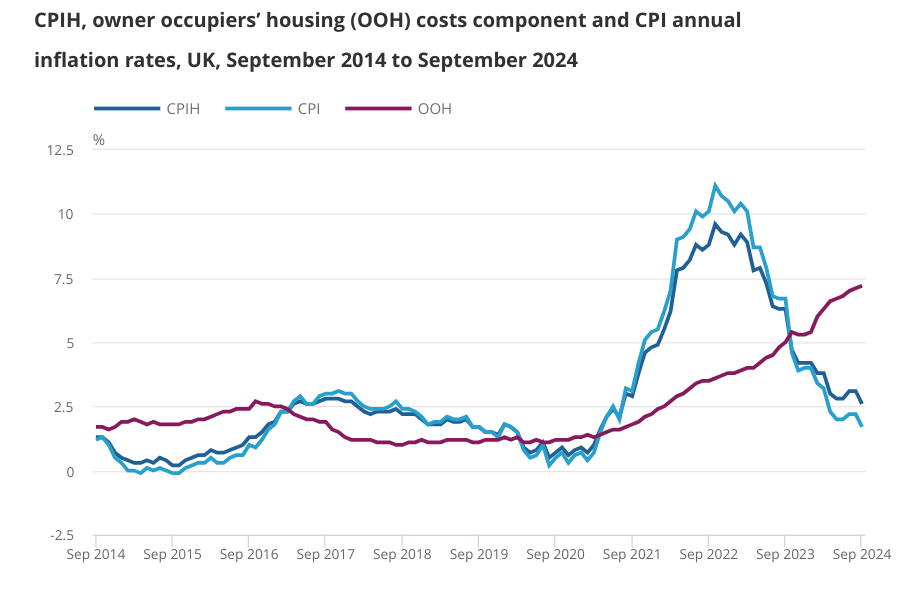

The consumer price index fell to 1.7 per cent in September, according to the Office for National Statistics (ONS), down from 2.2 per cent in August.

This was a bigger fall than economists had expected. City traders had expected inflation to fall to 1.9 per cent in September.

Core inflation, which strips out volatile components such as food and energy, fell to 3.2 per cent, also below expectations and down from 3.6 per cent the month before.

“Inflation eased in September to its lowest annual rate in over three years,” ONS Chief Economist Grant Fitzner said.

“Lower airfares and petrol prices were the biggest driver for this month’s fall. These were partially offset by increases for food and non-alcoholic drinks, the first time that food price inflation has strengthened since early last year,” he added.

The figures showed that services inflation eased much faster than expected, dropping to 4.9 per cent from 5.6 per cent in August. Economists had expected services inflation to fall to 5.2 per cent.

Services inflation has been a key measure for Bank officials as they seek to understand the underlying inflationary dynamics in the economy.

The sharp drop indicates that inflationary pressures might be easing faster than the Bank’s most recent forecasts would suggest.

Suren Thiru, economics director at ICAEW said the “notable drop” suggests domestic price pressures are becoming “less sticky”.

“The squeeze from slower economic activity and weaker wage growth should help keep it on a downward trajectory,” he continued.

Darren Jones, Chief Secretary to the Treasury, said it will be “welcome news for millions of families” that inflation is below two per cent.

September’s inflation figures came a day after official data showed a further easing in wage growth, which bolstered bets that the Bank would cut interest rates again in November.

Following this morning’s figures, the pound dropped sharply to just over $1.30, its lowest level since mid-August. Gilt yields fell across the curve too, suggesting markets expect a faster pace of interest rate cuts.

The Bank cut rates for the first time since the pandemic in August, but left rates on hold last month citing concerns about the persistence of inflation. This means the benchmark Bank Rate stands at five per cent.

Divisions have deepened in the Bank about the appropriate path for policy, with Governor Andrew Bailey suggesting he might back a more “activist” approach if inflation continues to moderate.

In contrast, Huw Pill, the Bank’s chief economist, has said there was “ample reason for caution” on interest rates.

But Anna Leach, chief economist at the Institute of Directors, said today’s figures help “smooth the path to the next rate cut”.

Although inflation has fallen below the two per cent target, the Bank’s forecasts suggest that it will rise over the remainder of the year to just under three per cent due to rising gas prices.