UK house prices rise for third straight month ahead of Budget

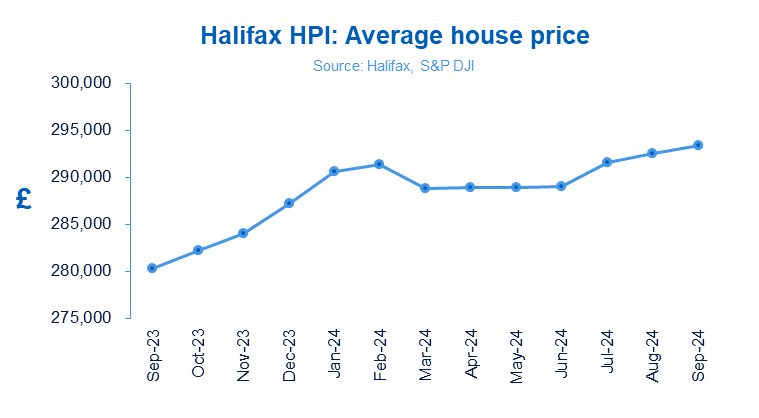

House prices rose for the third consecutive month in September, taking the average price of a property to the highest level in more than two years.

House prices increased by 0.3 per cent month on month in September, and 4.7 per cent year on year.

The average property now costs £293,399 – compared to £292,540 in August – the highest level since June 2022.

Despite the positive figures, head of mortgages at Halifax Amanda Bryden warned against taking the figures out of context.

“While the typical property value has risen by around £13,000 over the past year, this increase is largely a recovery of the ground lost over the previous 12 months… Looking back two years, prices have increased by just 0.4 per cent, or £1,202,” she said.

“While improved mortgage affordability should continue to support buyer activity – boosted by anticipated further cuts to interest rates – housing costs remain a challenge for many. As a result we expect property price growth over the rest of this year and into next to remain modest,” Bryden added.

Halifax said that London continues to have the most expensive property prices in the UK, now averaging £539,238, up +2.6 per cent compared to last year.

This is still some way below the capital’s peak property price of £552,592 set in August 2022.

Most economists think the Bank of England will be in a good position to cut rates in November.

Tom Bill, head of UK residential research, Knight Frank, said: “The last two years have underlined the close relationship between mortgage rates and house prices – as one goes up the other goes down.”

We expect low single-digit price growth this year as rates continue to drift lower, with the Budget the main cause of uncertainty on the horizon. If it better than feared, there is likely to be a relief bounce in activity before Christmas that lasts into next spring.”

Matt Thompson, head of sales at Chestertons, says: “Lower interest rates and sub-4% mortgage products saw more house hunters start their property search in September. The uplift in buyer activity, and looming changes to Capital Gains Tax in the upcoming Autumn Budget, also motivated sellers to put their property up for sale. We expect this level of market activity to continue and could see an additional boost in buyer motivation if the Bank of England decides to cut interest rates in November.”

Emma Jones, Managing Director at Whenthebanksaysno.co.uk said that falling mortgage rates and strong wage growth are “boosting affordability… and that is helping drive the market forward”.

“Lower borrowing costs in recent months have injected life into the market and that looks set to continue. Lenders fighting for market share is really stimulating demand and that is likely to carry on all the way up to Christmas. The obvious road bump ahead is the autumn Budget,” she added.

The Labour government is set to announce its first budget on 30 October, which is widely expected to contain tax hikes, particularly for the wealthy.

Stephen Perkins, managing director at Yellow Brick Mortgages, said that fears over the Autumn budget had helped to keep demand “resilient” before the upcoming budget “potentially takes the wind out of their sails”.

David Stirling, independent financial adviser at Mint Mortgages & Protection, said: “The good news is that there is still a southward trend in interest rates and lenders need to hit lending targets for 2024, so we can hopefully expect more cheaper rates to come available.”

“The bad news is that inflation, the Middle East conflict and the potentially spooky Halloween Budget are hanging over the property market like the Sword of Damocles. Any one of these could derail the market.”