Shop prices fall further into deflation as battle to ‘entice’ consumers continues

UK shop prices fell further into deflation in September, new figures show, as firms continued to cut prices in a bid to attract customers.

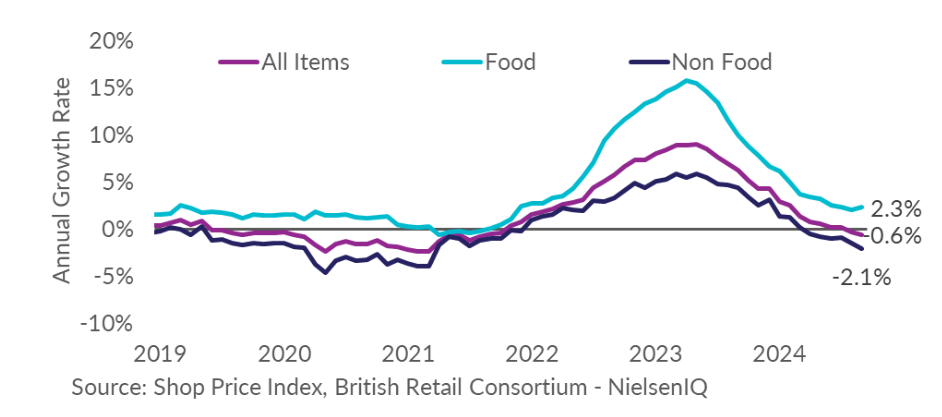

According to the British Retail Consortium (BRC), shop prices fell 0.6 per cent in the year-to-September, down from 0.3 per cent the previous month.

This put shop price inflation at its weakest level since August 2021, although the overall measure masked significant differences between food inflation and non-food.

Food inflation picked up to 2.3 per cent in September, up from 2.0 per cent the month before. In contrast, non-food prices fell -2.1 per cent in the year, falling from -1.5 per cent previously.

“September was a good month for bargain hunters as big discounts and fierce competition pushed shop prices further into deflation,” Helen Dickinson, chief executive of the BRC, said.

In particular, she highlighted hefty cuts to furniture and clothing prices as firms tried to “entice” consumers back to the shops.

Dickinson blamed the increase in food inflation on “poor harvests in key producing regions”, which led to higher prices for cooking oils and sugary products.

Although the survey suggests that inflationary pressures are dissipating, Dickinson warned that there were still plenty of dangers on the horizon.

Easing price inflation will certainly be welcomed by consumers, but ongoing geopolitical tensions, climate change, and government-imposed regulatory costs could all reverse this trend

The BRC’s figures will not be a game-changer for rate-setters at the Bank of England, given their focus on measures like services inflation. Nevertheless, the survey will still be well-received as it suggests there is currently little danger of another inflationary spiral.

Food prices hit a 45-year high in March last year due to the disruption which followed the Russian invasion of Ukraine, contributing to the worst surge in inflation since the 1970s.

Inflationary pressures have eased since then as supply chains have healed, but rate-setters at the Bank are still taking a cautious approach.

Governor Andrew Bailey said the Bank needs to be careful “not to cut interest rates too quickly or by too much” having lowered rates for the first time since the pandemic in August.