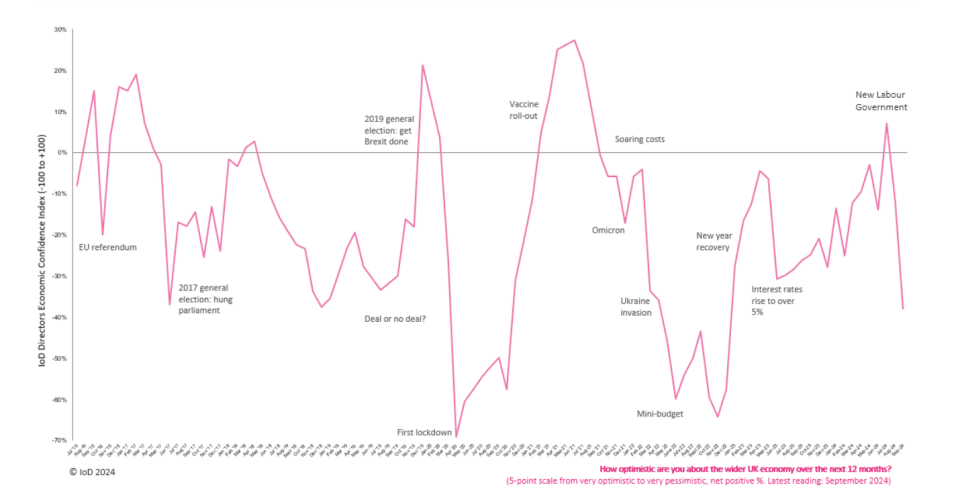

Business confidence takes ‘large dive’ in September as budget fears intensify

Business confidence plummeted in September, according to a closely watched survey, as business leaders nervously await details of Labour’s first budget.

The Institute of Directors’ (IoD) latest gauge of corporate optimism showed business leaders were increasingly gloomy about their firms’ prospects as well as the economy more broadly.

Optimism in the economic outlook fell to its lowest level since 2022, with the index dropping to -38 in September, down from -12 in August.

Confidence in firms’ own prospects also dipped to 15 in September, having been at 23 in August and 36 in July.

Reflecting the increasingly negative outlook, firms’ investment intentions dropped to the lowest level since September 2020. The survey put investment intentions at -6 in September, having dropped from 10 last month.

“Business confidence and investment expectations both took a further and larger dive in September,” Anna Leach, chief economist at the IoD said.

“IoD members cite ongoing concerns over likely tax increases, the cost of workers’ rights, international competitiveness, broader cost pressures and the general outlook for UK economic growth,” she said.

Business leaders are increasingly wary as the budget approaches.

The government is widely expected to hike taxes in the budget as it seeks to address an alleged £22bn blackhole in the public finances.

Its unclear exactly which taxes will increase, but many economists have argued that all the talk of “difficult decisions” has sent a chill through the economy.

Andy Haldane, former chief economist at the Bank of England, argued that Labour’s creation of a sense of “fear and foreboding” was “unnecessary and probably economically unhelpful.”

The IoD’s report is the latest in a number of surveys which point to decreasing confidence among businesses and households as the budget approaches.

A business confidence survey from Lloyds, published yesterday, showed business confidence fell to its lowest level in three months in September, although it still remained relatively high.

Consumer confidence surveys from GfK and the British Retail Consortium in recent weeks have also pointed to sharp falls owing to fears about potential tax hikes.