THG looks at separating THG Ingenuity arm

THG, the global beauty and nutrition group, has announced it’s looking to demerge its THG Ingenuity brand.

The company, which also owns City A.M. and is based in Manchester, told the market today it’s “actively undertaking detailed work to review potential structures to facilitate the demerger of THG Ingenuity.”

“At this stage no certainty can be provided on a demerger timescale whilst we consider the options to achieve this outcome, however, structuring tax clearances have now been approved by HMRC,” the company added.

Separately, the group said it was looking at transferring its listing from the equity shares (transition) category of the Official List maintained by the Financial Conduct Authority to the equity shares (commercial companies) (“ESCC”) category of the Official List.

After the transfer, THG said its stock “will be eligible to be considered for inclusion into the FTSE UK Index Series.”

THG announced these changes alongside its interim results for the half-year ended 30 June 2024.

The company reported revenue and adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) growth of 2.2 per cent and 1.6 per cent respectively on constant currency basis.

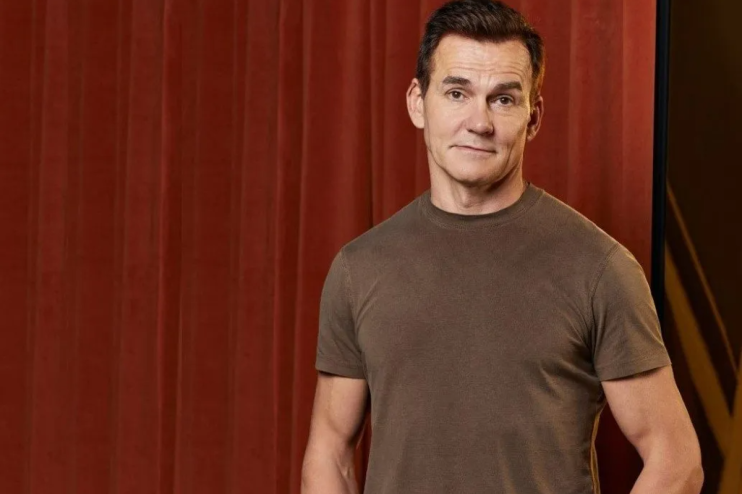

Matthew Moulding, CEO of THG, commented: “The group continued to deliver against its strategic priorities through H1, with the performances of both Beauty and Ingenuity particularly strong. Reporting another 6-month period of continuing sales and adjusted EBITDA growth was especially pleasing given the FX headwinds suffered within our Nutrition business, which negatively impacted H1 profitability by a further c.£5m. Local manufacturing and fulfilment is now live in Japan which will steadily scale to reduce exposure.

“Following the completion of the FCA listing regime review, we are taking the appropriate steps to transfer to the ESCC category. We welcome the output to simplify the listing regime, and expect the Group to be eligible for inclusion in the FTSE UK Index Series.

“Finally, after extensive discussions with shareholders over the past 12 months, THG is progressing options to demerge THG Ingenuity, leaving our highly profitable and cash generative global Beauty and Nutrition businesses within THG PLC. The appropriate tax clearances have been received, while the necessary separation work has previously been undertaken.”