Election 2024: This economic data is bad news – that’s why Sunak called a vote

The Conservatives are set to call an election for July 4th and will put a nascent economic recovery at the heart of their re-election pitch.

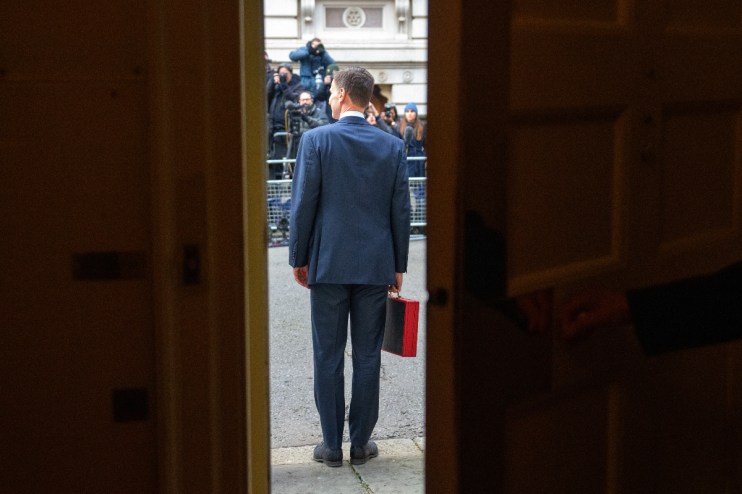

We’ve already heard the argument. With inflation falling and growth picking up, Rishi Sunak and Jeremy Hunt have said again and again that the “plan is working”.

But today’s election volte-face suggests that not everything is going as well as the government would like to admit.

The previous election strategy was to wait until autumn, when summer interest rate cuts and another round of tax cuts would add fuel to the UK’s budding economic recovery.

Today’s data releases ended those hopes. Inflation dropped to 2.3 per cent, its lowest level in nearly three years. This sounds like good news, and indeed the Prime Minister said the figures were a “major moment for the economy”.

But inflation was still ahead of expectations. City forecasters and the Bank of England both thought inflation would fall to 2.1 per cent.

This may not sound like a big difference, but underlying measures of inflation, which are more important than the headline level, came in well ahead of expectations.

Services inflation, a key indicator for the Bank, only fell to 5.9 per cent from 6.0 per cent the month before. The Bank of England thought it would fall to 5.5 per cent.

It is services inflation, not the headline level, which will do most to determine when the Bank of England will start cutting interest rates.

The market response this morning reflects the lack of progress on services inflation in April. Traders now think there is just a 12 per cent chance that the Bank will cut rates in June, down from 50 per cent at the beginning of the week.

A rate cut is not fully priced in until November, which is not to say that a cut before then is out of the question, but is quite a shift from a couple of weeks ago when an August cut was seen as a certainty too.

The Conservatives were waiting for interest rates to start falling in the hope that this will help add another kick to the economic recovery. Earlier this year, Hunt said the economic “feelgood factor” would be stronger in the autumn as interest rates started to fall.

After April’s inflation figures, summer rate cuts no longer look a certainty. And remember, the Bank think inflation will pick up again later in the year, potentially nearing three per cent by the autumn.

Another major strand of the Conservative’s autumn strategy was the hope that they could cut taxes again ahead of the election. There was bad news on this front, too.

According to figures from the Office for National Statistics (ONS), the difference between government income and spending last month was £20.5bn. This was £1.2bn more than forecast by the Office for Budget Responsibility and ahead of economists’ expectations too.

Alex Kerr, assistant economist at Capital Economics, said: “April’s public finances figures got the new 2024/25 fiscal year off to a shaky start and cast further doubt on the Chancellor’s ability to unveil big tax cuts at another pre-election fiscal event later this year.”

These figures came after the International Monetary Fund (IMF) warned that there was a £30bn spending blackhole in the government’s fiscal plans, warning Hunt against cutting taxes again.

Following the figures, Rob Wood, chief UK economist at Pantheon Macroeconomics, noted “there isn’t room for tax cuts”.

This was bad economic news for the Conservatives. Ironically, that’s why they called the election.