Exiled Hong Kong activist: HSBC ‘short-sighted’ for lobbying Sunak to ease China crackdown

A leading Hong Kong pro-democracy activist has called major firms like HSBC and Standard Chartered “short-sighted” for lobbying the UK government to ease its planned clampdowns on China.

A number of major British companies with connections to China are pressing Rishi Sunak’s government to tone down proposed measures on doing business in the country, two people familiar with the matter told City A.M.

The firms include banks HSBC and Standard Chartered, as well as insurance giant Prudential. The Confederation of British Industry (CBI) is also understood to be involved. All the groups and the prime minister’s office declined to comment on the lobbying.

Executives are calling for China not to be included in the strictest risk category within new national security legislation, arguing it could hurt business and stoke negative publicity for firms that have ties to the communist-controlled country.

A source close to the lobbying efforts said the companies wanted to guarantee “the right balance of economic and national security interests, such as ensuring that any non-sensitive commercial activity isn’t caught through increased compliance”.

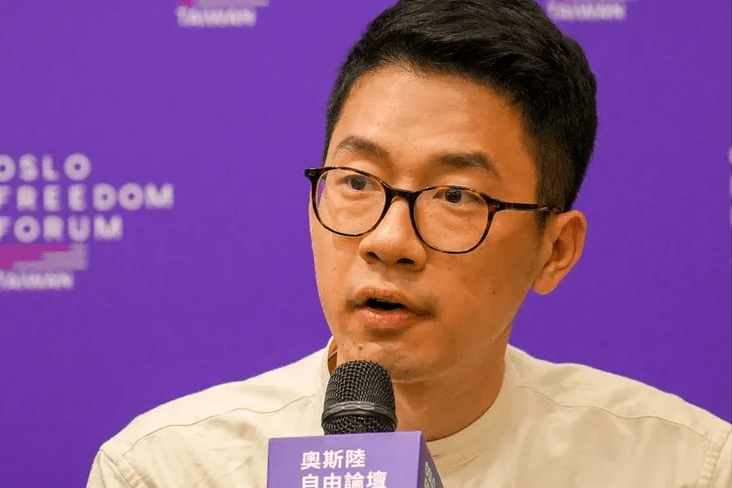

“I think this is definitely a very short-sighted way of doing things,” Nathan Law, a former member of Hong Kong’s parliament now in exile in the UK, told City A.M.

“We all know that China is a big business partner. But at the end of the day, it all has to build on us defending our democracy, our liberal values and national security. And I think it is unwise to try and gain short-term economic rewards but give up the moral authority.”

Law, one of the most prominent figures in Hong Kong’s pro-democracy movement, fled to the UK in 2020 where he was granted political asylum the following year.

News of the lobbying, first reported by Bloomberg, comes as ministers consider how to designate China under a National Security Act passed last year that will require firms doing business with certain nations deemed a “potential risk to UK safety” to declare it.

China is the world’s second-largest economy and one of the UK’s biggest trading partners, but its relationship with the West has been tense in recent years over issues like its treatment of protestors in Hong Kong and spying allegations.

“Increasing the transparency of any of these commercial corporations in mainland China, especially those entities that are connected to the Chinese government, is really important,” Law said.

“China is very good at manipulating the power it has to exert influence and urge these companies to work for them.”

London-based HSBC and Standard Chartered are among the biggest foreign-owned financial firms operating in China.

HSBC has recently exited markets in countries like Canada and Argentina as part of a pivot to expand in Asia, while Standard Chartered is growing its investment banking activity in China through a new securities business there.

“I am not surprised that as they are expanding aggressively in Asia, they want to please the Chinese government and help them to continue all those more covert actions of spreading propaganda or undermining democracy,” Law said.

“HSBC has been quite notoriously compliant with Beijing and the Hong Kong government. There are so many cases where it has frozen Hong Kong human right activists’ accounts without due process. And it has been showing its public support for the national security law in Hong Kong, which is undermining the city’s freedom and civil society.”

Foreign secretary David Cameron said earlier this year that China’s proposal for a new national security law in Hong Kong would inhibit freedom of speech, expression and the press.

HSBC declined to respond to Law’s comments when approached by City A.M. Standard Chartered did not respond to a request for comment.