National Grid reforms set to drive returns at Gresham House Energy Storage Fund and Harmony Energy

Gresham House Energy Storage Fund and Harmony Energy Income have put the ‘battle’ in ’embattled’ over the past year, but a glimmer of a potential light has now appeared at the end of the tunnel.

Falling power prices, increased competition, and disconnections from the National Grid have rocked the battery storage-focused investment trusts.

Gresham House Energy Storage Fund, the largest of the UK’s battery storage firms, saw its value plunge to a 70 per cent discount to its net asset value this year, exacerbated by its decision in February to cut its dividend.

Harmony, too, slashed investor payouts, causing its share price to dive 46 per cent in 2024.

But both have seen gains in recent days, apparently out of the blue.

Shares in Gresham House Energy Storage Fund have risen 7.25 per cent in the last few days, while Harmony’ Energy Income is up 5.5 per cent.

Battery storage facilities earn revenue buying and selling power in the wholesale market. The National Grid’s Electricity Systems Operator (ESO) is responsible for matching supply and demand across the network and will pay the battery storage providers to store and duly supply power when needed.

But the Grid’s ESO frequently ends up going to other sources such as gas-fired power stations that have been a key part of its ecosystem for years. Old habits are hard to break.

Speaking to City A.M. earlier this year, Gresham House’s managing director Ben Guest said the firm was “perhaps naive,” in assuming the National Grid would prioritise cleaner but more nascent power sources such as battery storage over legacy players.

“The balancing market is operated in order of merit, so if you’re competitive, you should be used,” Guest said at the time, but “gas-fired stations with storage have been there for decades, and the grid is used to dealing with them.”

So why has market sentiment toward Gresham House and Harmony shifted so much in recent days?

The shift seems to be a result of higher prices paid by National Grid’s balancing system.

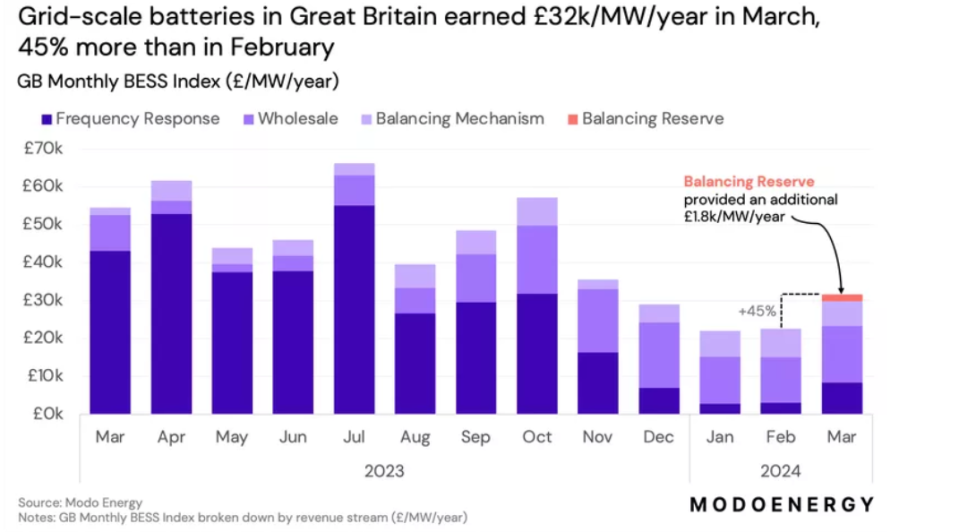

Prices have jumped in March, as displayed below by energy data specialists Modo.

Revenues from battery energy storage systems have jumped from around £23,000 per megawatt per year in February to £32,000 per MW/year in March.

This has been driven by a leap in frequency response, or how often the Grid is drawing power from battery storage assets.

Furthermore, the Grid has now also introduced the balancing reserve, which allows batteries to be contracted in the reserve market for the first time ever.

Additionally, the Grid updated its algorithm to allow battery storage facilities to supply energy for up to 30 minutes; previously, the Grid only permitted power trades for 15 minutes or less.

Gresham House’s Ben Guest told City A.M. this week that the changes were a “significantly positive development.”

“There are other milestones to come, so we will have to wait and see what impact they may have,” he said.

“We are seeing a lot more effort within the control room at National Grid in that there are more dedicated people for batteries, but it must be remembered we are starting from a very low level.”

Revenues from wholesale trading and the balancing mechanism continue to account for the large proportion of money coming in, but the uptick is substantial.

However, battery storage assets have still seen drastically lower power requests from the Grid compared to 2023.

As a result, it could take a lot more for Gresham House and Harmony to close their deep discounts to net asset value.

Stifel analyst Sachin Saggar recently penned that Harmony could consider asset sales or a “sit tight” approach to allow for the still-nascent battery storage market to correct on the back of National Grid developments.

Harmony’s position actually allows it “breathing space” to consider the weaker revenue environment, Saggar added.

Harmony told City A.M.: “Since the launch of Balancing Reserve and the removal of the “15-minute rule” in March we have seen an increase in the consistency of application by National Grid ESO, and captured volumes in the Balancing Mechanism have risen 313% since January for the portfolio.

“This has helped to drive a significant improvement in revenues for the portfolio. These are encouraging signals and there remains further room for improvement which, coupled with continued widening of wholesale spreads, should support a continuation of the upward trend in battery revenues.”

Gore Street Energy Storage Fund, the third largest in the UK sector, is hedged against the volatility experienced by both Gresham and Harmony, given a significant portfolio of overseas assets that do not rely on the National Grid.

Gore Street’s share price is up 3.3 per cent in the last week, but also remains down on the year to date, to the tune of just over 28 per cent.