House prices fall in March as market continues rates-driven seesaw

House prices slipped in March despite rising optimism that interest rates are on their way down.

Property remains up on an annual basis – by 1.6 per cent – but fell on a monthly basis by 0.2 per cent.

Experts however said that there were reasons to remain optimistic about house prices remaining on a broadly upward trend.

Britain’s biggest building society showed that although there was another rise in house prices in March, on a monthly basis they dipped by 0.2 per cent.

The average UK house price had barely moved from the previous month, sitting at £261,142, but London easily kept its crown as the most expensive in the country, with an average of £519,505.

This was an annual increase of 1.6 per cent, and a monthly fall of 2.4 per cent.

This marks a continued recovery for the London property market as Brits continue to hold off buying until interest rates come down from their historic highs. The Bank of England held them at 5.25 per cent again, with most experts betting they will drop later in the summer.

Rightmove reported last month that March saw the highest rise in house prices in 10 months with average price of newly marketed properties rose by £5,279 to £368,000.

Nationwide’s latest figures come after Zoopla reported that property sellers in London have been shaving as much as £19,500 off asking prices to secure a sale, as Brits wait for the right time to sell.

This also follows new government figures, which showed that average price house prices were £2,000 cheaper in January compared to the same period the year before.

Robert Gardner, Nationwide’s chief economist, said: “UK house prices fell by 0.2 per cent in March, after taking account of seasonal effects. Nevertheless, the annual rate of house price growth edged higher to 1.6 per cent in March, from 1.2 per cent in February.

“Activity has picked up from the weak levels prevailing towards the end of 2023 but remain relatively subdued by historic standards. For example, the number of mortgages approved for house purchase in January was around 15 per cent below pre-pandemic levels.

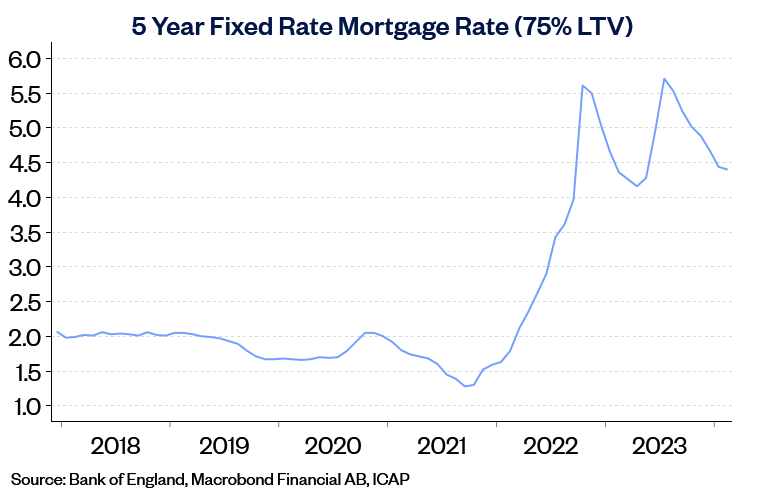

“This largely reflects the impact of higher interest rates on affordability. While mortgage rates are below the peaks seen in mid-2023, they remain well above the lows prevailing in the wake of the pandemic.

He added that falling inflation and the UK likely to exit a shallow recession will improve consumer sentiment with “surveyors report a pickup in new buyer enquiries and new instructions to sell in recent months. Moreover, with income growth continuing to outpace house price growth by a healthy margin, housing affordability is improving, albeit gradually.”

He said “If these trends are maintained, activity is likely to gain momentum, though the pace of the recovery is still likely to be heavily influenced by the trajectory of interest rates.

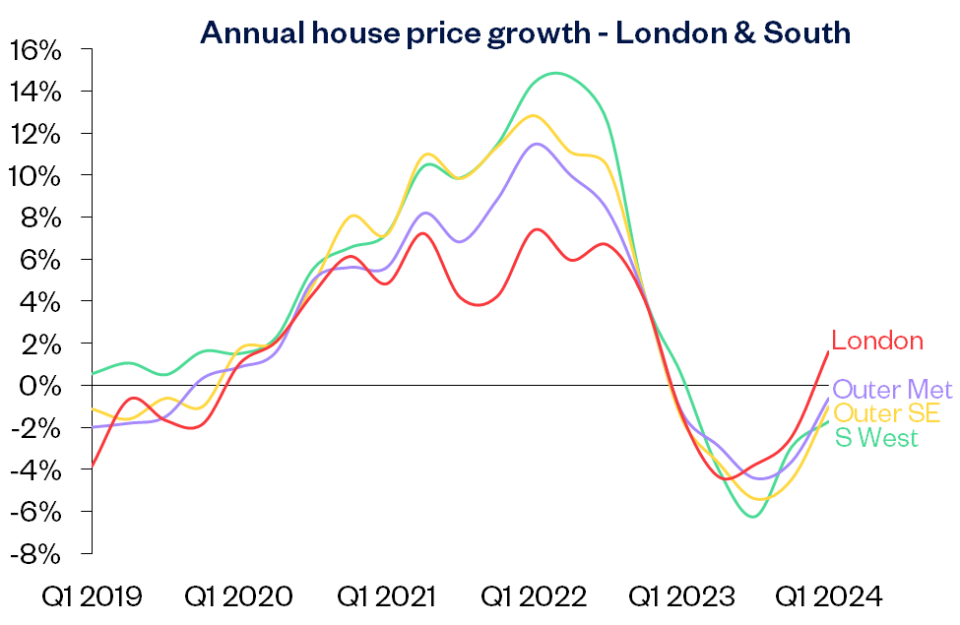

Gardner added “that while some regions recorded annual price declines, there was an improvement in the annual rate of change across all areas” with house prices across England up 0.4 per cent on the first quarter of 2023, while the south saw a 0.3 per cent year-on-year fall.

“London remained the best performing southern region with annual price growth recovering to 1.6 per cent. The South West was the weakest performing region, with prices down 1.7 per cent year-on-year.”

Nathan Emerson, chief of Propertymark, said: “Sellers have every reason to start feeling positive about putting their home up for sale and being able to go on to buy their next perfect property. 2024 has shown a positive trend that house prices are growing once again following three years of economic turbulence.

“However the UK Government must look to make houses equally affordable for buyers and that can only be done by building more houses. Propertymark’s own Housing Insight Report found there has been an 80 per cent increase in the number of new properties becoming available, ultimately making it easier for people to consider a move.”