BlackRock chooses Ethereum for their tokenised investment fund

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

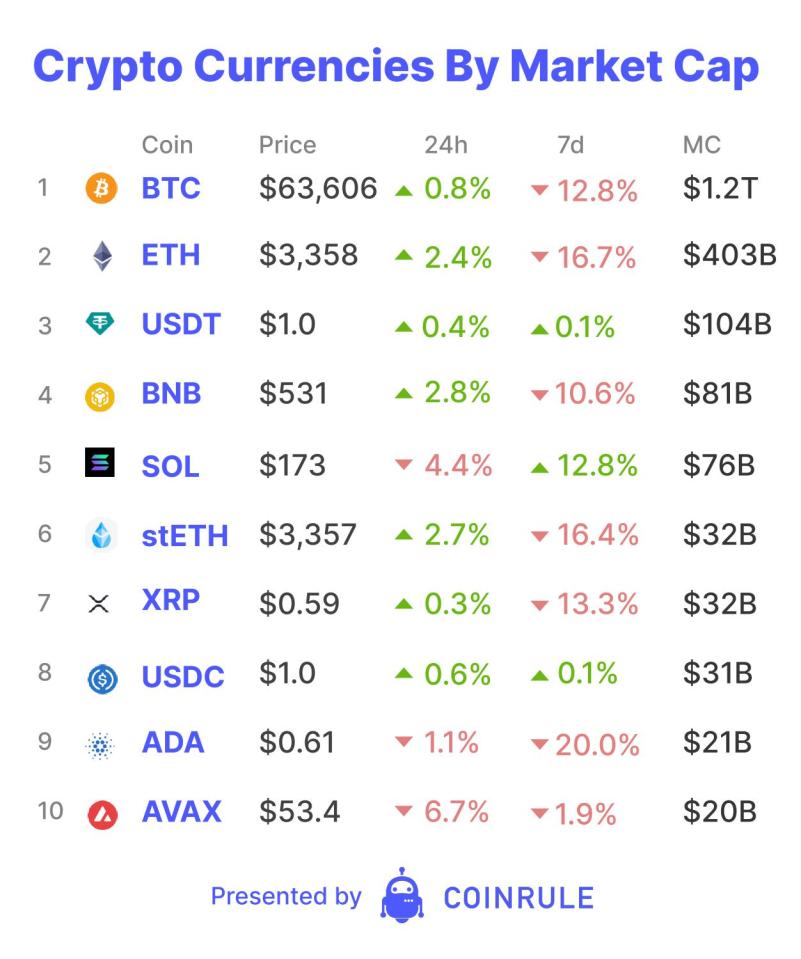

Tuesday was another record day for the Bitcoin ETFs. This time, it was a new record in terms of outflows, with $326 million leaving the Bitcoin invested funds. Not even BlackRock’s IBIT could save the day with inflows of only $75 million. But, even with the market cratering, it wasn’t all bad news. BlackRock’s SEC filing of their USD Institutional Digital Liquidity Fund to invest in tokenised assets was a reminder how much more money can potentially flow into crypto.

Larry Fink previously stated he saw value in an Ethereum ETF, but it will just be a “stepping stone towards tokenisation.” It seems like he truly meant it. Last Thursday, BlackRock submitted a filing to the SEC for their USD Institutional Digital Liquidity Fund, called BUIDL. The fund will invest in tokenised assets on the Ethereum blockchain, using Securitize as their broker. Market participants discovered the fund’s on-chain wallet has $100 million of USDC ready to invest. Since the wallet became public knowledge, it has received an assortment of tokens. The deposits are an interesting form of marketing, with all eyes watching the BUIDL wallet.

The creation of the fund is a big deal in further legitimising crypto as an asset class to invest in. Since the ETFs, Bitcoin is increasingly accepted as a store-of-value alternative to gold by traditional investors and as a first step into the crypto world. The next step would be to introduce investing in other “Layer 1” blockchains, such as Ethereum or Solana. What BUIDL could potentially enable is step 3. This is investing in assets built on top of Layer 1s, with Ethereum being the obvious first choice.

Right now, information on where exactly investments will go within the Ethereum ecosystem is not available. But, the fund has made it clear, BlackRock is betting on Ethereum, with the chain being able to cater to their tastes. According to DefiLlama, Ethereum has over 55% of the total value locked across all chains with nearly $50 billion. The vast majority of tokens with potential use cases are also launched on Ethereum with the Layer 1 having over 1,000. It is becoming more obvious that this will be the place institutions first dip their toes; either by investing in assets, or using DeFi applications.

With BlackRock’s nearly perfect ETF approval record and the recent launch of BUIDL on Ethereum, is this an indication there is still hope for the ETF approval deadline in May? T-minus 63 days until we find out.