Will a British ISA really boost the London Stock Exchange?

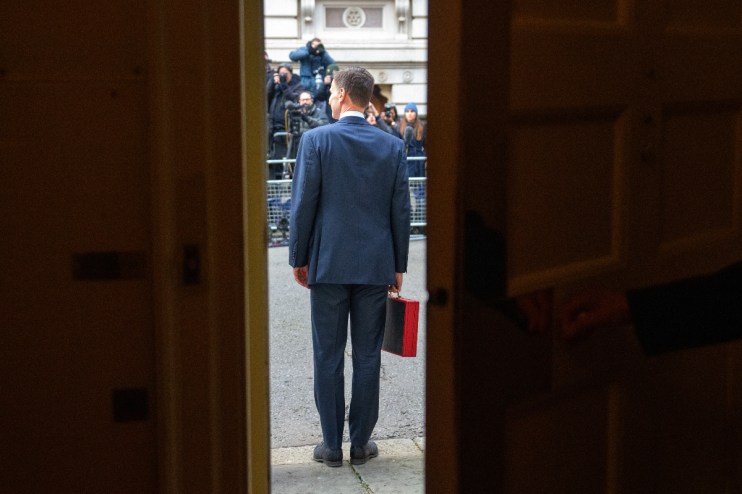

Jeremy Hunt confirmed much trailed plans for a British ISA in the budget on Wednesday in a bid to get cash flowing into London’s beleaguered stock market.

The move will look to incentivise investment into UK equities by offering tax breaks to retail punters after a slide in the overall amount of cash flowing into the market in recent years.

The new British ISA, which will be launched following a three-month consultation, allows savers to invest an extra £5,000 tax-free in UK equities, on top of the £20,000 ISA allowance.

While this was a key campaign issue for some in the finance industry, with Chancellor Jeremy Hunt citing calls from “over 200 representatives of the City and our high growth sectors” during the Budget, not everyone has been supportive of the move.

“I think there are other measures which would have been much more powerful,” Sree Kochugovindan, senior economics at Abrdn, tells City A.M. Bonds & Ballots this week.

“The number of people who actually own ISAs who are actually on top of those investments is quite small in the UK, relative to other countries. So in terms of the impact and investments into UK firms, it might be quite limited, unfortunately.”

Kochugovindan said scrapping stamp duty on shares would have been a more meaningful change in encouraging appetite for investment into the market.

The warnings follow push back from some of the country’s biggest retail trading platforms this week over the effectiveness of the plans.

Michael Summersgill, chief executive at AJ Bell, slammed the new ISA as an “ill-conceived, politically motivated decision” following the Budget.

A key point against the British ISA has been that only 15 per cent of ISA investors use the maximum £20,000, leaving a small pool of investors that will actually utilise the new product.

“In the context of the £2trn+ UK stock market, any additional investment generated by these investors through the British ISA will be a rounding error,” added Summersgill.

The plans have also been criticised heavily for introducing further complexity into the ISA system, rather than focusing on the government’s already stated goal of simplifying the ISA landscape.

James Carter, head of platform product policy at Fidelity International, emphasised that one of the main barriers that deters consumers from investing is complexity.

“Therefore, plans for a ‘Great British ISA’ must focus on simplicity,” he said.