Could ETFs drive the market and signal the end of the bear run?

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets

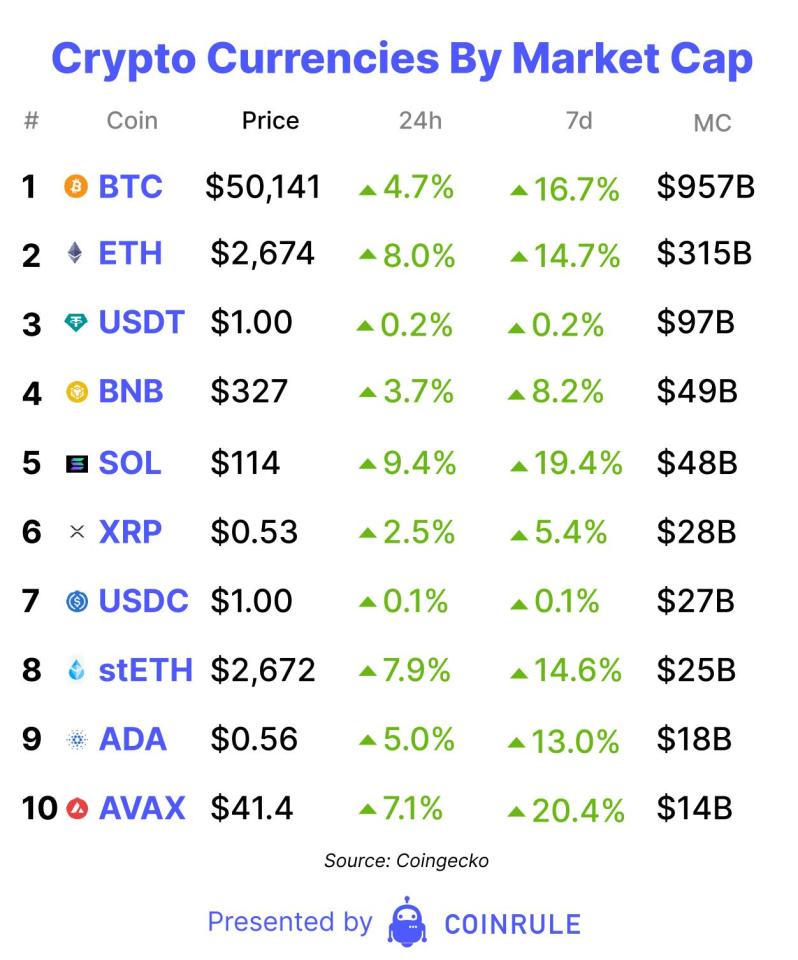

These are the kind of days that make it fun to be in crypto. As Bitcoin shot through the $50,000 price level, the whole market followed suit. Ethereum is up over 8% over a 24h period at the time of writing, Solana is up almost 10%. These are the days that make up for the 70-95% price drops which we experience during bear markets.

During the 2021 Bull Market, Bitcoin ran up from around the $30,000 price level all the way up to $56,000 in the month of February. That happened over a 3 week period. In that time however, Bitcoin was blowing up across Google Searches and the Coinbase app was shooting up in the App Store ranking. Retail investors were driving the parabolic rally. This time is different. Bitcoin is at $50,000 but according to Google Trends, Bitcoin searches are still below even 2022 levels. Most retail investors have not yet started to pay attention. Clearly, this rally has still more room to run.

If it is not Retail’s Fear-Of-Missing-Out (FOMO), then what are the factors driving this rally? For one, the Bitcoin ETF launch was unusually successful. In fact, measured by its $4.2 billion of inflows, Blackrock’s Bitcoin Spot ETF IBIT was the most successful ETF launch of the past 30 years. Fidelity’s Bitcoin ETF saw $3.5 billion of inflows and came a close second. That is out of 5,535 ETF launches according to Bloomberg Intelligence ETF expert Eric Balchunas. Multiple other Bitcoin ETFs such as Ark and Bitwise recorded inflows in the $1 billion range. Even if counting this against outflows from Grayscale’s Bitcoin Trust ETF, the previously closed Bitcoin Fund, net ETF inflows are in the billions.

The interesting question then becomes: who are these buyers? Both retail and sophisticated traders would have already been able to buy Bitcoin directly through exchanges such as Coinbase. Inevitably, this must be a buyer segment that was either prevented to buy Bitcoin Spot due to legal constraints or a segment that did not want to deal with custody and related risks. This description fits many institutional investors such as Mutual Funds, Pension Funds and Family Offices. As portfolio allocations to ‘Digital Currencies’ become normal for institutional players, the question of when Bitcoin will reach $100,000 becomes one of ‘when’, not ‘if’.