Bank of England to cut interest rates in May as inflation forecast to undershoot target by summer

Inflation will fall to two per cent in the spring and stay there enabling the Bank of England to cut interest rates in May, according to new forecasts.

Falling energy prices will push the headline rate of inflation below the two per cent target early this year, according to the National Institute of Economic and Social Research (NIESR).

The think tank expects that inflation will average just 1.2 per cent in the second quarter of 2024 before rebounding to two per cent by the end of 2024. Inflation will then “settle” at the two per cent target “over the medium term”.

NIESR’s forecasts contrast with the most recent round of the Bank of England’s forecasting. While the Bank suggested inflation would fall to two per cent in the spring, it predicted inflation would pick up to end the year around 2.7 per cent.

Lower inflation will enable the Bank to start cutting interest rates in May, NIESR predicted. From there rate cuts will proceed more slowly than markets expect with rates expected to stand at 4.5 per cent by the year’s end.

With rate cuts on the table, the think tank argued that policymakers at the Bank could provide clearer forward guidance on the timing and extent of rate cuts.

The report said greater clarity would be “very valuable” and “provide a stable framework for the savings and investment decisions of households and firms”.

“The Bank should be more proactive in guiding markets,” Benjamin Caswell, senior economist at NIESR said, arguing that it would improve market efficiency.

Although inflation is expected to fall sharply and remain low, NIESR flagged the near 10 per cent increase in minimum wage as a potential obstacle to further progress on core inflation. The increase comes into force this April.

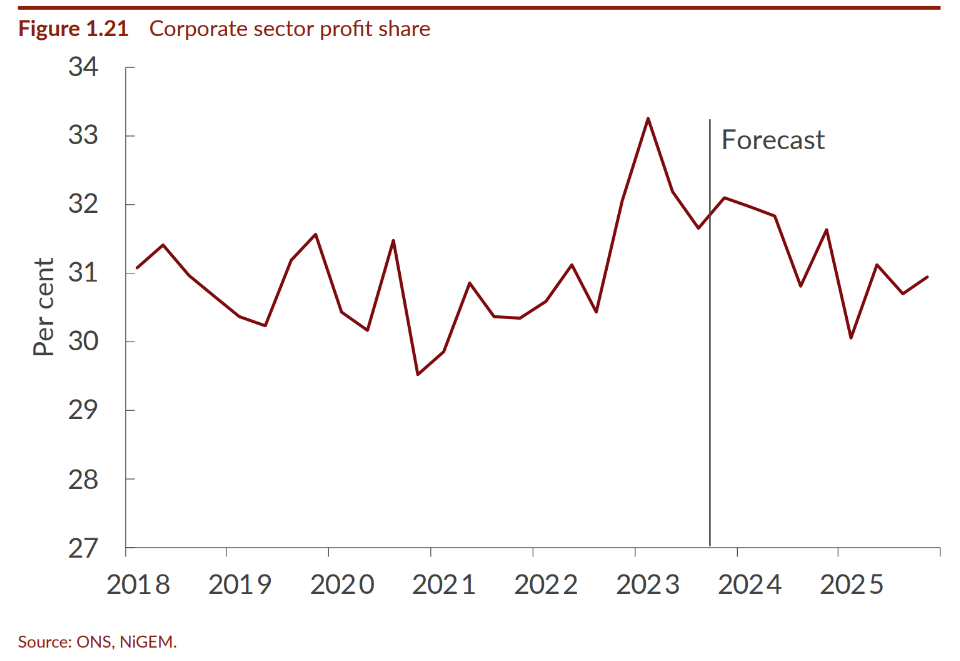

Firms saw swollen profit margins in the aftermath of the pandemic, allowing them to absorb higher wages without passing costs onto consumers, NIESR said. But as margins have eroded, further wage pressures might have to be passed onto consumers.

“Firms may be less able to absorb the increased costs associated with the forthcoming rise in the National Minimum Wage than the last, given both rises have been historically high, and therefore forced to pass the costs on with higher price rises,” the report noted.