Big companies at risk as nearly a fifth of listed firms issue profit warnings in 2023

Large listed companies came under increasing financial strain over 2023, new figures show, as the burden of higher interest rates weighed heavily on corporate balance sheets.

In the final quarter of last year, listed companies issued 77 profit warnings according to EY’s profit warnings monitor. A third of these warnings from firms with annual revenue of over £1bn, around double the average rate.

Firms in the consumer discretionary space accounted for 35 per cent of all warnings in the final quarter while industrials made up 31 per cent.

Among consumer facing firms, Dr Martens, Kingfisher and Superdry all issued profit warnings in the final quarter of last year, as did Ashtead, which rents out industrial equipment.

Profit warnings refer to official statements from listed companies that full-year profits will be materially below expectations.

EY’s report suggested that cost pressures were beginning to ease, making up just 10 per cent of warnings – down from 41 per cent in the final quarter of 2022.

However, higher interest rates and corporate spending delays became increasingly problematic for businesses. Nearly a quarter of profit warnings in the second half of 2023 related to higher interest rates, up from just 14 per cent in the first half of the year.

“While pressure around costs eased somewhat toward the year-end, the uptick in warnings caused by delays to business decisions and weak consumer confidence indicates an ongoing reluctance to commit to discretionary spending,” Jo Robinson, partner at EY-Parthenon said.

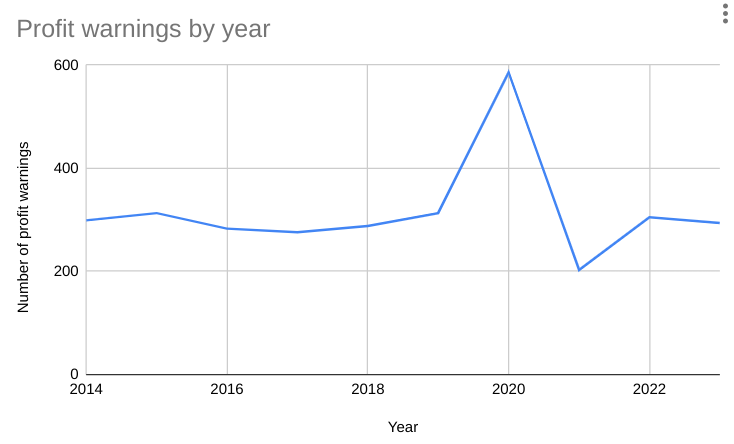

Across 2023 as a whole, listed firms issued 294 profit warnings last year meaning nearly a fifth of all firms expected to meaningfully undershoot expectations.

This meant that 2023 saw more profit warnings than at the peak of the financial crisis, although it was roughly in line with the average over the past decade.

Retailers in particular were feeling the pinch with 40 per cent of FTSE retailers warning during 2023 as discretionary spending was hit by cost-of-living pressures.

“Consumer spending on staples has recovered, but an elevated level of warnings in FTSE Retailers highlights the persistent strain on discretionary spending,” George Mills, partner at EY said.