Natwest chair says “it’s not that difficult” to buy a house. The data disagrees.

It is not “that difficult” for first time buyers to get on the housing ladder, the chair of Natwest has claimed, despite a closely watched index today revealing property prices have continued to climb around the country.

Sir Howard Davies, chairman of the under-fire retail bank, said prospective buyers have to save, and that “is the way it always used to be”.

“I don’t think it is that difficult at the moment,” he told BBC Radio 4’s Today programme.

“I totally recognise that there are people who are finding it very difficult to start the process, they will have to save more, but that is, I think, inherent in the change in the financial system as a result of the mistakes that were made in the last global financial crisis,” he added.

Housing affordability data, however, disagrees, as do campaigners and mortgage advisers who said the comments were “ludicrous” and “insulting”.

The comments are likely to trigger anger after a tumultuous year for the market in which mortgage rates have been sent rocketing by inflation and rate hikes from the Bank of England. Some lenders have begun to cut rates in the past week however in anticipation of the Bank scaling back rates later this year.

The market has seen a drop-off as buyers have been shut out by the rapid climb in rates. Figures from Yorkshire Building Society this week found that the number of first-time buyers who bought a home through a mortgage through the firm fell to its lowest level in a decade in 2023.

House prices around the country continued to climb last month however, ahead of what is expected to be a rebound in prices this year. Property values were reported to have increased by 1.7 per cent on average across 2023, with the average home valued £4,800 higher than at the end of 2022, according to the Halifax house price index today.

Making such bold statements with absolutely nothing to back it up is ludicrous

Katy Eatenton

Average house prices rose by 1.1 per cent month-on-month in December, the third monthly rise in a row.

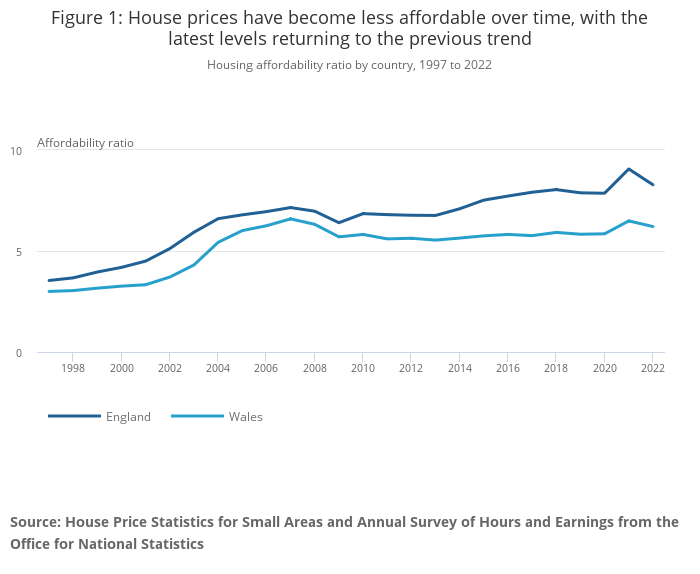

According to the ONS’s latest housing affordability data in March 2023, full-time employees in England could expect to spend around 8.3 times their annual earnings buying a home.

Over the last 25 years, housing affordability has worsened in every area of England, felt particularly acutely in London and surrounding areas.

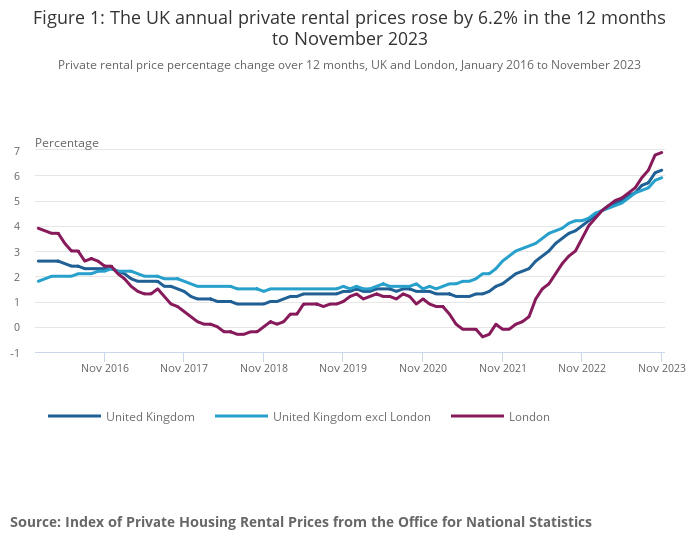

Those figures, however, do not take into account the fact that renting has also increased in cost in recent years – making it more difficult to save for a deposit.

According to a 2023 report by the Centre for Policy Studies, based on official data, rents are also climbing as a share of income.

Whereas private renters spent 10 per cent of their income on housing from the 1960s to the 1980s, the share of income spent on rent has risen to 30 per cent in recent years, and almost 40 per cent in London.

According to recent ONS data, rents have spiked even faster in the last year.

The Natwest chair’s comments were roundly slammed by property experts and mortgage advisers today, who criticised the comments as “out of touch with reality”.

“Making such bold statements with absolutely nothing to back it up is ludicrous,” said Katy Eatenton, a mortgage specialist at Lifetime Wealth Management. “The cost of living is the highest it has been, rents are increasing year on year and house prices, interest rates and the lack of first-time buyer schemes are all adding to the difficulty in getting on the property ladder.”

Stephen Perkins, managing director at Yellow Brick Mortgages added it was “tiring” hearing such comments from “people who bought their first house for around £10,000 with a minimal deposit and a mortgage at 2-3 times their income”.

And Emma Revell at the Centre for Policy Studies said of the Natwest boardroom chief’s comments: “It’s all well and good for Sir Howard Davies to say it’s not that difficult to buy a home but that is not reflective of the reality for millions of Brits, especially in London and the South East.

“Figures released by Halifax today show average house prices going up by almost £5,000 in 2023, despite the impact of inflation on mortgage affordability. In England in 2022, full-time employees could expect to spend 8.3 times their earnings on purchasing a home, and much more in London, compared to 5.1 times earnings in 2002. House prices are consistently outpacing people’s ability to save and it is insulting that Davies dismisses this.

“Davies may well feel that NatWest itself does a good job in supporting prospective home buyers but the reality is without serious effort to build more homes, entire generations will be locked out of home ownership for good.”