Shares in banks and housing firms rise on sharp inflation slowdown

Shares in banks and housing companies jumped on Wednesday morning after fresh inflation data came in lower than expected, boosting hopes for interest rate cuts in the first half of next year.

Markets have priced in a cut for May 2024, with investors betting that inflation will keep cooling and high borrowing costs will dampen economic growth.

Barclays was among the biggest winners on the FTSE 100 index, shooting up 2.7 per cent.

Lloyds, the country’s biggest high street lender, ticked up one per cent and was also the index’s most-traded stock.

HSBC, the index’s third biggest stock by market capitalisation, rose 0.8 per cent. Meanwhile, Legal and General, which provides mortgage services, rose 1.7 per cent.

Inflation fell further than expected in November, according to figures from the ONS, emboldening bets that the Bank of England will cut rates in the first half of next year.

The consumer price index came in at 3.9 per cent in October, down from 4.6 per cent the month before. Economists had expected a figure of 4.3 per cent.

Property firms Segro and Taylor Wimpey gained 1.8 and 1.2 per cent respectively as the inflation data added to hopes of aggressive mortgage rate cuts next year.

“With around 1.5 million homeowners whose fixed rate mortgages are up for renewal in 2024, these numbers are likely to further increase competition amongst lenders to offer better and better deals,” said Danni Hewson, head of financial analysis at AJ Bell.

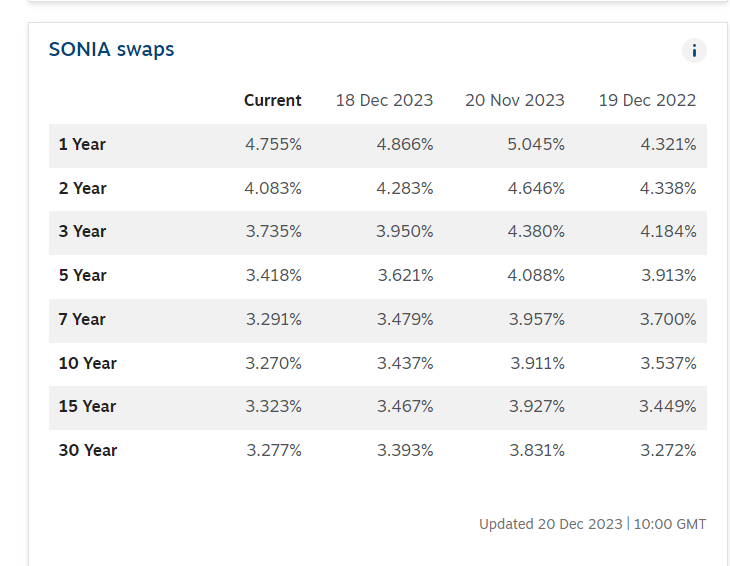

Mortgage rates are influenced by SONIA swap rates – the main interest rate benchmark in sterling markets.

Chris Sykes, technical director at Private Finance, told City A.M. that the “really positive” inflation data this morning meant these rates continued to climb down, with five-year swaps falling around 0.2 per cent to 3.4 per cent.

“This means that it is now realistic for us to see a sub four per cent five-year fixed rate in the near future, which will be incredible for the market, with that sort of rate being seen as not too harsh of a blow and hopefully bringing some zest to the market over the coming years,” he added.

“This must be what is encouraging homebuilding stocks, as developers have been worried both by material costs for future projects as well as buyer demand for the properties that they build.”

Magni Finance director Ashley Thomas said it looked “very likely that a number of lenders will have rates below four per cent”.

He added: “For people looking get a mortgage or remortgage soon, this is very positive – the best it has been for a while. It looks like the worst is over with inflation coming in lower than expected. Expect to see a mortgage price war early next year.”