Why Goldman Sachs predict ‘earlier and more aggressive’ interest rate cuts from central banks

Goldman Sachs expects “earlier and more aggressive rate cuts” from central banks in advanced economies after a significant fall in inflation over recent months.

In a note published this morning, the US investment bank said “global inflation continues to plummet”.

Across the range of economies that saw a post-COVID surge in inflation, Goldman estimated that core inflation in the past three months stood at 2.2 per cent on an annual basis.

This will allow central banks to move more quickly to lower interest rates, it predicts.

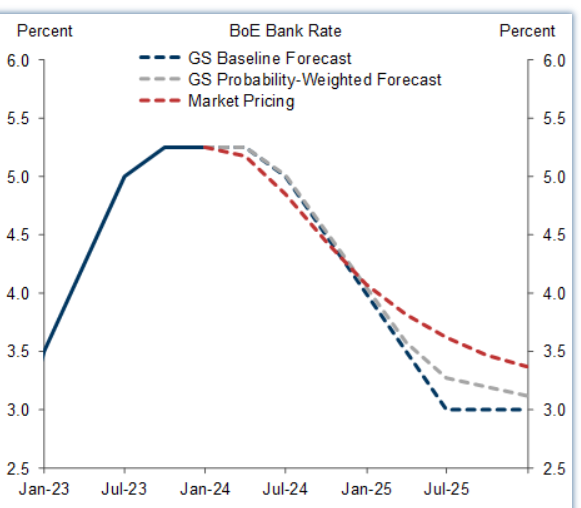

After leaving rates on hold for the third consecutive meeting last week, Goldman now expects the Bank of England to begin cutting rates in June. It previously pencilled in the first rate cut for August.

Goldman then predicts 225 basis points of consecutive rate cuts, bringing the Bank Rate to three per cent by mid-2025.

Goldman’s confidence in the inflation outlook comes after inflation dropped sharply in October, falling from 6.7 per cent to 4.6 per cent.

Further progress is expected this week when November’s figures are released. Goldman expects a further drop in the headline rate of inflation to 4.3 per cent, comfortably below the Bank’s own estimates.

It also predicts a “meaningful” drop in services inflation to 6.4 per cent from 6.6 per cent the month before.

In the US, Goldman noted the change in tone has been “particularly abrupt”. It said interest rate cuts will begin in March with five cuts forecast across next year as inflation has slowed dramatically.

This follows last week’s meeting of the Federal Open Market Committee (FOMC), where policymakers confirmed policy was sufficiently restrictive and pencilled in three rate cuts for 2024.

The European Central Bank remains relatively hawkish, but Goldman still expected a long string of rate cuts to ease pressure on the flagging European economy.

“Whatever the precise date (for rate cuts), however, the argument for a long string of consecutive 25bp cuts is stronger in Europe than in the US because the inflation data have been even softer and growth remains substantially weaker,” the note said.