Thames Water: We can’t pay our debts – our bills are too low

Thames Water is set to plead with lenders to extend the collection date of a £190m loan that it currently cannot pay back – with its chairman pinning the blame for the firm’s financial troubles on ‘very low’ customer bills.

The £190m is due in April – one chunk of around £1.4bn maturing in the coming months – but today the firm admitted it didn’t have the cash on hand to pay it back.

The firm is waiting for a decision from the regulator on what it can charge customers.

At a hearing of the Environment, Food and Rural Affairs committee today, Sir Adrian Montague, who serves as chair both of Thames and its parent company Kemble Holdings, said: “we will talk to the lenders about it in the new year and our proposition is ‘please can you extend that maturity’ because everything about Thames will be much clearer from a financial perspective after we have received Ofwat’s determination,”

“I think we would say that some of the problems that we are now encountering were because bills were kept deliberately very low over the past period,” Sir Adrian said.

Before 2025, the company is looking to receive £750m from shareholders; a crew of international pension funds spanning Canada, Australia, China and the UAE among others.

It is also seeking an additional £2.5bn from shareholders between 2025 and 2030 to finance its £18.7bn investment plan for the 2025-2030 period.

But this is contingent upon the finalisation of the company’s business plan and the regulatory framework from Ofwat, the preliminary verdict of which is expected between May and June with a final decision following this time next year.

In reply to Mr Montague, Barry Gardiner MP, former shadow secretary of state for energy and climate change, said: “That determination from Ofwat could go against you couldn’t it?”.

“It could, totally,” Mr Montague replied.

There has been a furore in recent weeks over some of Thames Water’s financial dealings, centred around the details of a £500m injection.

Before today’s inquiry began, Sir Adrian Montague apologised to the parliamentary committee for “any confusion” the monopoly caused by calling the funding equity.

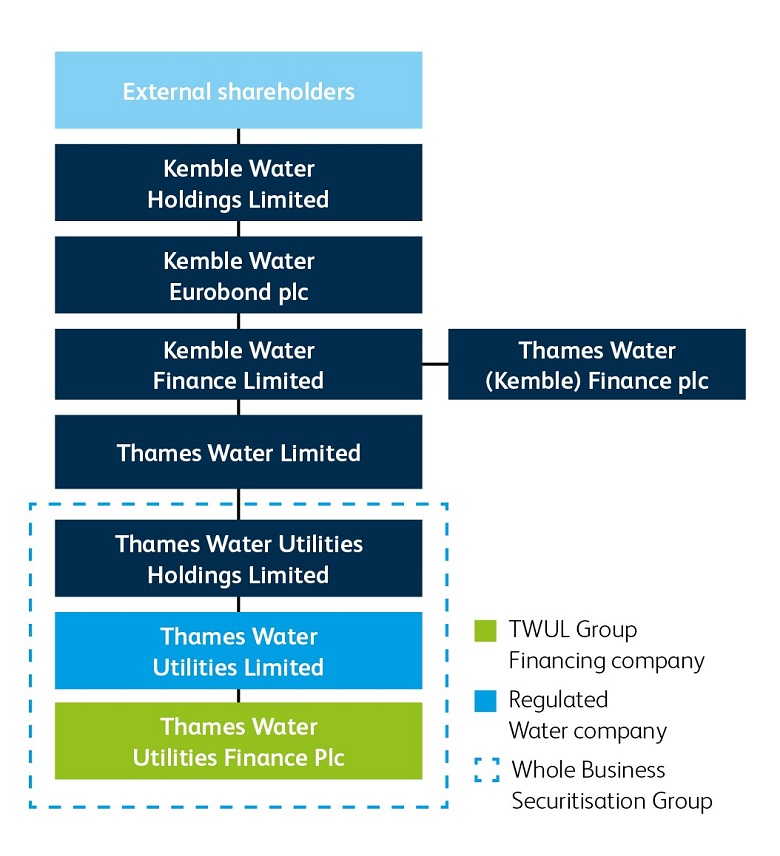

In a 2nd December letter sent to Sir Robert Goodwill, chairman of the Environment, Food and Rural Affairs Select Committee, Thames Water leadership stressed that the company’s shareholders are not on the hook for the £500m “equity funding” due to the way it was filtered through the company’s complex structure.

Thames Water the utility provider is also referred to as Thames Water Utilities Holdings.

According to the document, Thames Water’s parent company, Kemble Holdings, loaned £500m to Kemble Water Eurobond, another company owned by Kemble in the form of a convertible note with 8 per cent interest.

Eurobond subsequently purchased around £480m of shares in another Kemble company, Kemble Water Finance, and settled around £20m of debts owed to the latter – bringing the total transferred from Eurobond to Water Finance to £500m.

Kemble Water Finance then purchased £500m of shares in Thames Water Ltd, which subsequently purchased £500m of new shares in Thames Water Utilities Holdings.

In the hearing today, Mr Gardiner asserted that this complicated procedure served as a way to trickle the loan down through the company and to avoid classification as a debt.

“But when the debt is called in and holding group doesn’t have the money,” he continued.

“The only place they can get it from is from Thames Water – the bill payers.”

As part of the company’s recently-released business plan to tackle spills and leaks, its customers could be faced with paying around £174 pounds a year more in bills.

In a quarterly update last week, co-chief executives Cathryn Ross and Alastair Cochran said turning the firm around will “take time” and it would be impossible “to do everything that our customers and stakeholders wish to see at a pace and for a price that everyone would like.”